Is Apple Still A Buy At Current Levels???

steemleo·@rollandthomas·

0.000 HBDIs Apple Still A Buy At Current Levels???

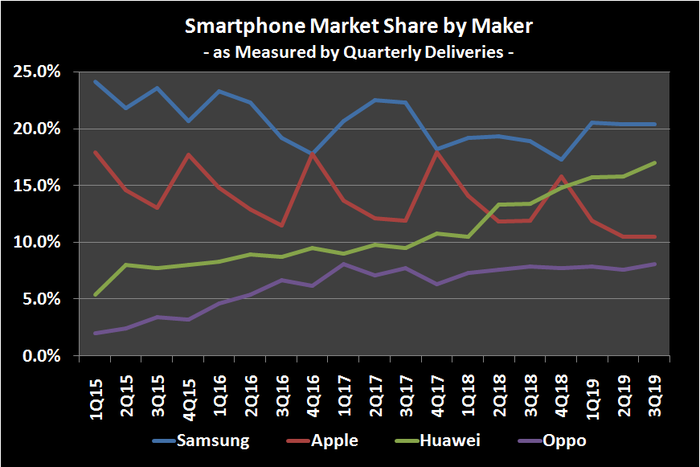

<center></center> Buffett through Berkshire first bought Apple in February 2017 and by the end of 2017, Berkshire owned 165 million Apple shares. But Buffett didn’t stop there, Berkshire bought an additional 75 million shares in the first quarter of 2018. At that time, Berkshire owned 5% of Apple’s outstanding shares and said he would love to own 100% of it. Recently, Berkshire added more than 10 million shares of Suncor, over 4 million shares Red Hat and Berkshire decreased its stake in Apple by nearly 3 million shares in the fourth quarter. Additional, purchases included 20 million shares of General Motors and 14 million shares of J.P. Morgan. However, the one stock that he decreased his stake in was Apple, by 3 million share. <center></center> Harvard Management Company, the Harvard-owned investment company which is the largest academic endowment in the world, has sold all of its Apple stock as well. At the end of the second quarter, Harvard reported just over $100 million in Apple. However, their third quarter filing stated they sold all of its securities in Apple. After falling almost 10% in 2018, Apple has been the best performing FANG stock in year-to-day, risen nearly 40% YTD. Apple has warmed up to investors due to a return to growth in the 2nd half of 2019, services revenue and margin’s increasing and wearables revenue increasing as well. But has the stock got ahead of itself based on Buffet and Harvard Management Co selling Apple. iPhone is still the bread winner for Apple and the competition is still on the tail of Apple. <blockquote> It's not exactly a new trend, but it's an extension of a trend that should gnaw at Apple (NASDAQ:AAPL) shareholders while it delights owners of over-the-counter equity Samsung (OTC:SSNLF). That trend is Samsung continuing to grow its share of the smartphone market, taking most of that added share away from Apple's iPhone. Though still sporting a smaller piece of the market than Samsung, Huawei garnered even more of the smartphone market for itself during the third quarter of the year, according to fresh data from technology market research organization Gartner.  In some regards, it doesn't entirely matter. Apple knew this day was coming long ago, and it has already waded deeper into digital services like music, video, and apps. Still, each passing quarter that sees Apple lose share of this important market increasingly puts pressure on the company's young services arm. </blockquote> <center><a href=https://www.fool.com/investing/2019/12/01/samsung-widens-smartphone-share-at-apple-expense.aspx>Source</a></center> Apple has reportedly boosted component orders for the iPhone 11. In addition, according to one Analyst, Apple AirPods are seeing a surge of demand and could face holiday shortage. So just like a trending market, you have to buy the pull backs until the bend at the end of the trend. Apple's stock is no different as the chart suggest to buy Apple on a pull back to the daily demand at $256.  This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions. <center>https://steemitimages.com/DQmRhDtjokAZnGKi4QwheqksKTFo6m4fsjMYsNNrsitC1xk/upvote%20banner3.gif</center>

👍 stmdev, coredump, dtrade, botony, haxxdump, abh12345.leo, jk6276.leo, mindtrap-leo, bearjohn, flipstar.sports, tonimontana.leo, tonimontana.neo, exe8422, moeenali, leovoter, laissez-faire, khaleelkazi, smartbee, leo.curator, cryptopassionleo, cd-leo, limka, anti-fraud, project007.leo, nin4i, jk6276, neal.leo, sra976, ziomalek, chapaj, krotow1989, erihon, sinistor, kira32, buggedout, steempope, astil.codex, ilias.fragment, edkarnie, leo.syndication, leo.voter, flauwy, nealmcspadden, pearltwin, therabbitzone, steem.leo, zaku-leo, spinvest-leo, leotrail, thebilpcointrain, purefood, bilpcoin.pay, toofasteddie, teutonium, freemanjaro, enison1, apoloo1, znnuksfe, scaredycatguide, mitchelljaworski, sebas04, newageinv, plook, no-advice, blocktvnews, felander.leo, xiaoq, vxc.leo, cn-leo, leoexplorers, missmodness, felixpower, goinvesting, edgmer, hamsa.quality, kaili, crookshanks, moserich, timm-caja, timm, escapeamericanow, fortinbuff, heyimsnuffles, ervinneb, mitrin, mrbullishsail, carrinm, anotherjoe, scripsio, pcste, okean123, astral, shaunmza, alexrickard86, liberlandpress, siriusgaia, avisk, kiokizz, paulo380, sm-lvl1, darhainer, espni, sm-starter-beta, investorsclub, anthrovegan, desmond41, duckmast3r, batzax, neoxiancity, justinashby, thecryptodwarf, rajib2k5, sqljoker, steemitboard, baling, swalow, scaredycatcurate, megavest, witcher73,