Top And Worst Asset Performers For The Week Of 3/9/20

hive-167922·@rollandthomas·

0.000 HBDTop And Worst Asset Performers For The Week Of 3/9/20

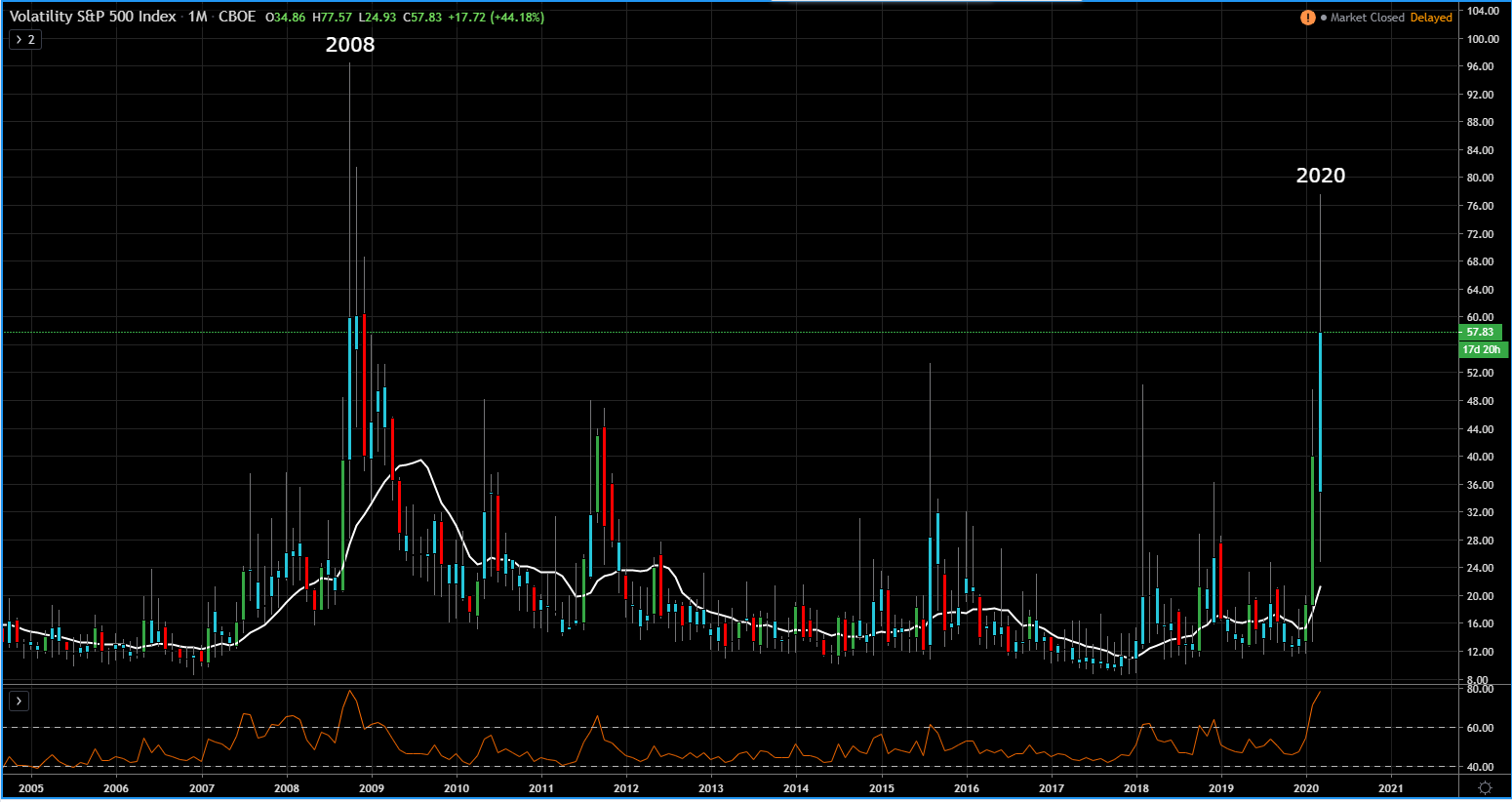

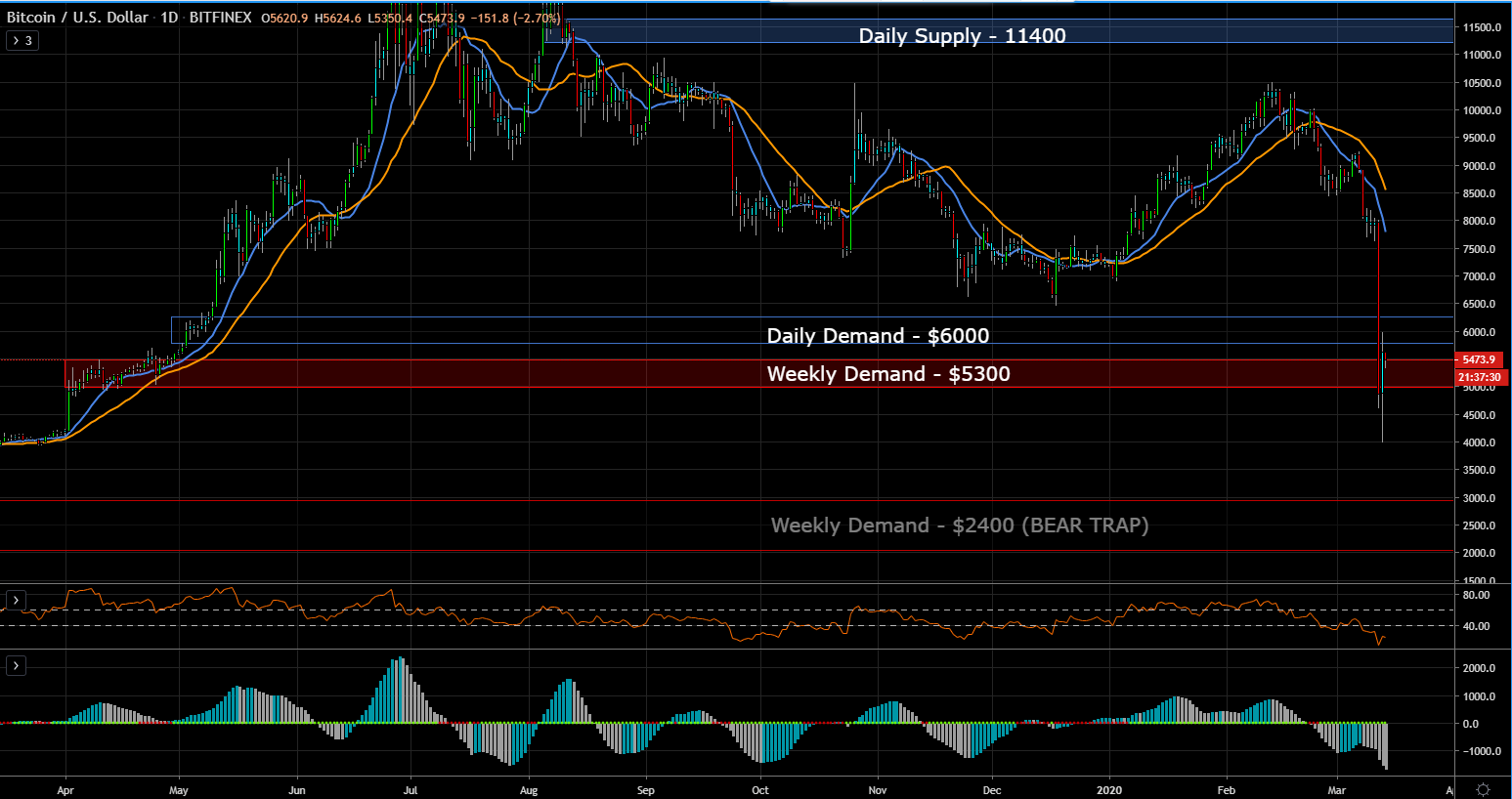

<center>https://mentormarket.io/wp-content/uploads/2019/12/winlose.png</center> <br/><p>Intermarket analysis is a powerful tool that gives traders/investors a macro predictive direction of stocks, bonds, commodities and currencies. Intermarket analysis states that all asset classes are interrelated and that you can’t definitively determine the direction of one asset class without examining the other asset classes.</p> <p>There are several key relationships that bind these four markets together. These relationships include:</p> <p>The INVERSE relationship between commodities and bonds.<br>The INVERSE relationship between bonds and stocks.<br>The POSITIVE relationship between stocks and commodities.<br>The INVERSE relationship between the US Dollar and commodities.</p> <p>The overall goal of the intermarket analysis is to identify top performers or the markets that are outperforming others. With all that said, the top and worst performers from this past week are the following:</p> <p>Top Performers</p> S&P 500 VIX: 44.77% The VIX measures the volatility over the last 30 days on the S&P 500. Also known, as the fear gauge, VIX values greater than 30 represent risk off trading environments and VIX values less than 20 represent calm Markets. Despite the surge in US equities on Friday, the Dow Jones Industrial Average, Nasdaq and the S&P 500 had their worst weekly drop since 2008. But this doesn’t do it justice, the S&P 500 lost more than four months’ of gains in just seven trading days. As a result, the VIX spiked to 75 on and has stayed above VIX has closed above 50 for four days straight.  Natural Gas: +9.43% U.S. Dollar Index: +3.26% <blockquote> The Dollar surged at a shock-and-awe-inspiring pace against all currencies Thursday as risk assets hemorrhaged more capital and investors flocked toward the liquidity and perceived safety of the U.S. greenback. The Dollar Index was 1.75% higher at 98.14 Thursday, completing a reversal of last week's -3% decline and marking the largest one-day increase for the U.S. currency since at least when the trade war with China really got going back in August 2018. </blockquote> <center><a href="https://www.poundsterlinglive.com/usd/12940-pound-to-dollar-rate-suffers-worst-loss-since-flash-crash-amid-shock-and-awe-inspiring-gains-for-u-s-greenback">Source</a></center>  Worst Performers Bitcoin CME Futures: -41.84% Bitcoin lost half it's value by dropping 50% over the past two days. Bitcoin aka digital gold, didn't act like gold this week. But don't feel bad, neither did gold as gold fell too. The reason, COVID-19 has forced margin calls and investor wanted to seek safer haven assets. Bitcoin has since breached the daily and weekly demand zones and hit the $4000 level before bouncing back.  Palladium: -38.13% Gasoline RBOB: -35.26% This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions. <center>https://steemitimages.com/DQmRhDtjokAZnGKi4QwheqksKTFo6m4fsjMYsNNrsitC1xk/upvote%20banner3.gif</center> Posted via <a href="https://steemleo.com/">Steemleo</a>

👍 fantasycrypto, moeenali, stmdev, coredump, haxxdump, jk6276.leo, mindtrap-leo, bearjohn, babytarazkp, spinvest-leo, tonimontana.leo, tonimontana.neo, toni.pal, ldelegations, limka, dtrade, dalz1, abh12345.leo, leovoter, flipstar.sports, project007.leo, thejollyroger, vxc, dalz, steempope, leomaniacsgr, nealmcspadden, therabbitzone, exe8422, discernente, toofasteddie, teutonium, steem-key, freemanjaro, bruleo, enison1, buggedout, scaredycatguide, diverse, no-advice, blocktvnews, mitchelljaworski, r1s2g3, newageinv, break-out-trader, trumpman2, plook, felander.leo, achim03.leo, anti-fraud, cn-leo, kaili, carrinm, moserich, investorsclub, anthrovegan, plemmons, poiscrame, apofis, anderson91, summertooth, leo.voter, investprosper, pearltwin, zaku-leo, w4d, kuhle, xiaoq, leoexplorers, ph1102.leo, chireerocks.leo, maranan, rehan-leo, aotearoa, bala-leo,