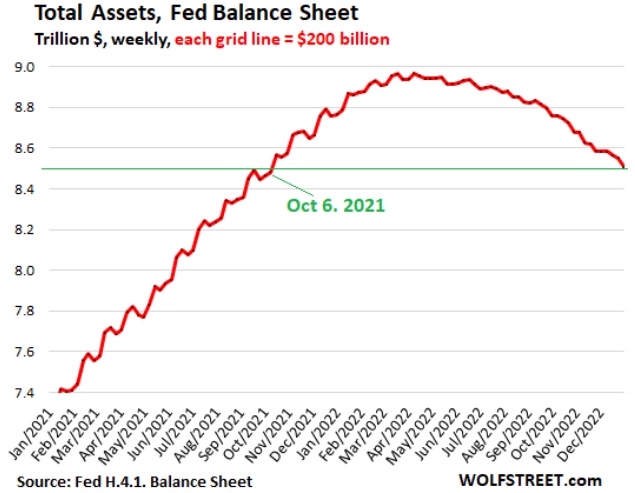

Federal Reserve Quantitative Tightening takes Fed balance sheet back to what it was in October 2021

economy·@rose98734·

0.000 HBDFederal Reserve Quantitative Tightening takes Fed balance sheet back to what it was in October 2021

The news cycle moves so fast, that a lot of people have forgotten that the Fed foolishly carried out Quantitative Easing until March 2022, even though inflation had been above it's target for over six months. But still - Jay Powell finally got religion and started to reverse it and do Quantitative Tightening. Here's the chart:  [source](https://wolfstreet.com/wp-content/uploads/2023/01/US-Fed-Balance-sheet-2023-01-05-total-assets-detail.png) They've managed to reduce the balance sheet by $458 billion since the peak. But in order to reverse all the pandemic QE, they need to get rid of another $1.1 trillion. That will take at least another 18 months. The markets hate Quantitative Tightening - it's sucking out the liquidity that buoyed the stock market during the pandemic. But anyone who thinks the Fed is going to stop this year is deluding themselves. With China re-opening causing a renewed demand for oil and other commodities, inflationary pressures won't go away.

👍 pixelfan, elector, goldfoot, botito, tobor, hadaly, dotmatrix, curabot, chomps, freysa, lunapark, weebo, otomo, swissbot, quicktrade, buffybot, hypnobot, psybot, chatbot, psychobot, misery, freebot, cresus, honeybot, dtake, quicktrades, droida, tmps, ufm.pay, archonapp, taskmanager, archon-mining, archonbank, doubledice, archon-drips, archon-gov, bidnat, irisworld, upfundme, candy49, onealfa.leo, onealfa.vyb, teatree, rose98734, alyssasanders,