How To Add Liquidity

hive-131131·@rubilu·

0.000 HBDHow To Add Liquidity

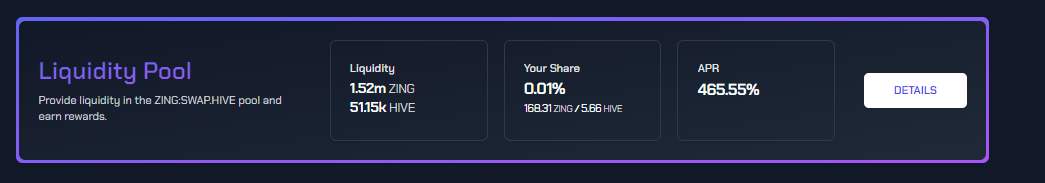

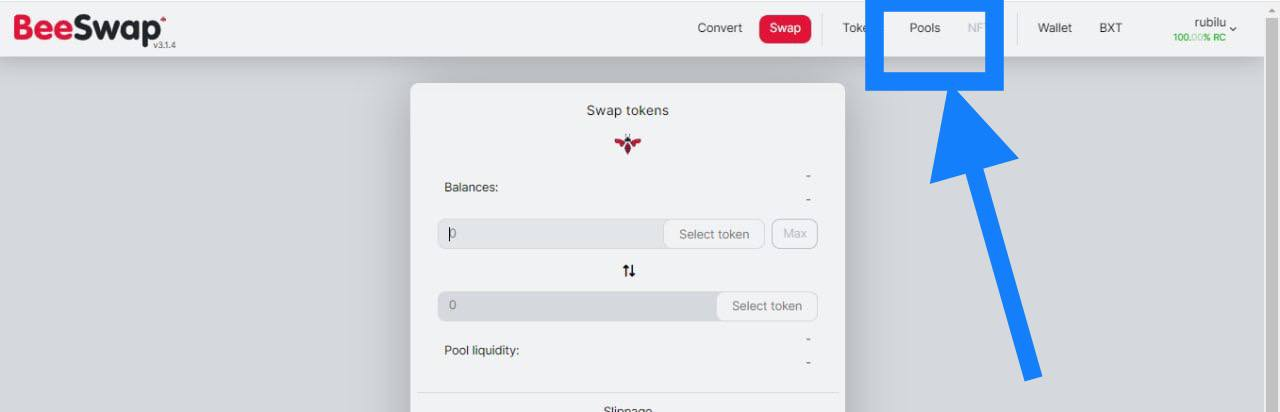

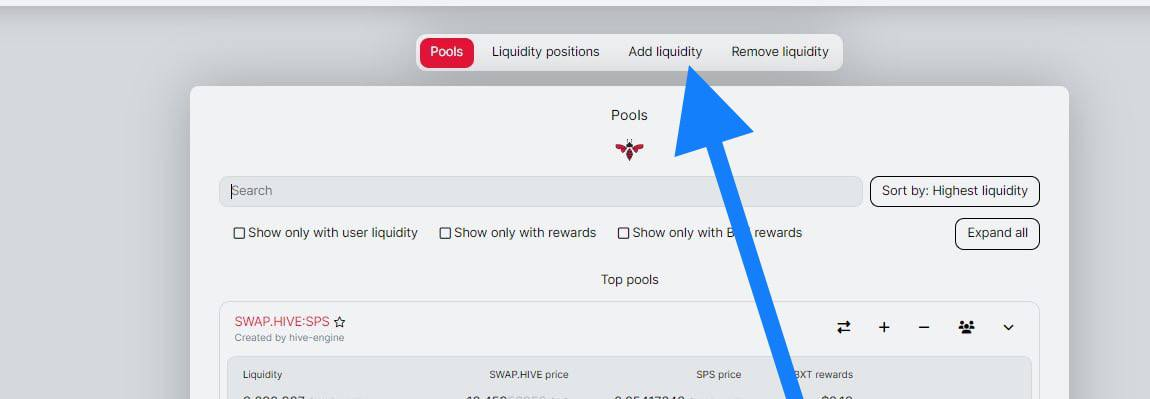

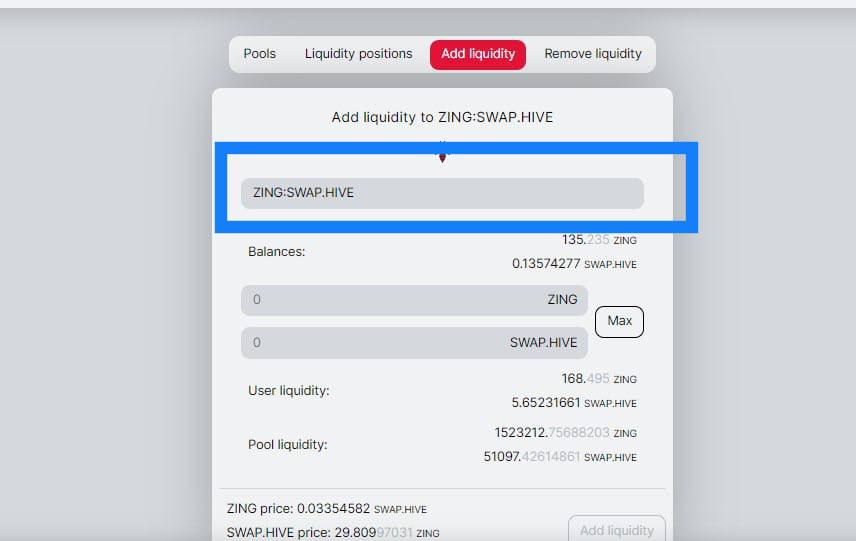

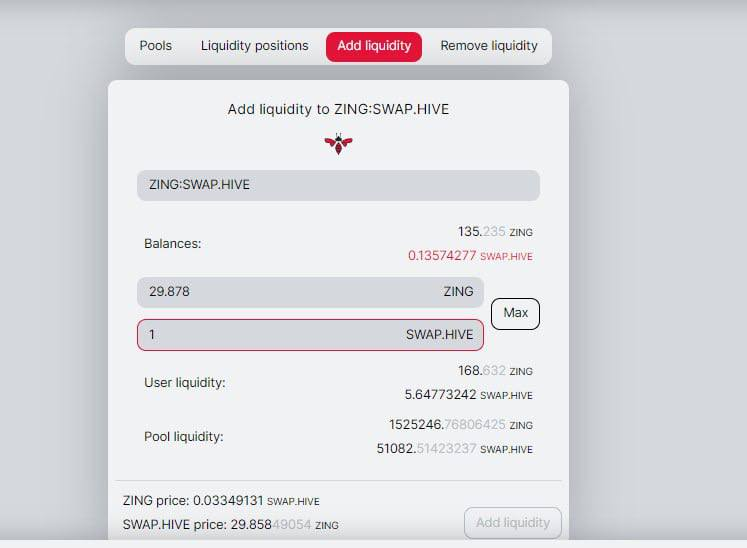

------------ <CENTER>  </CENTER> -------------- <div class="text-justify"> Liquidity, I’ve had a couple of people ask me what at all liquidity is and how to add it to start earning zing. Some people may not know, but liquidity adding has been there for a very long time and some people are just realizing it now. Some people have made it their goal to try and add liquidity to small projects to be able to earn passively. The ROI on things are very important to me. Over the long term, you get to enjoy it even though what you get is usually a small quantity over days. If you’re not someone who likes to get in on small investments over the long term it might look like a tiring or boring process to you, but I kid you not. It does pay off if you can hold on. So what at all is liquidity? In cryptocurrency terms, liquidity is what allows a user to sell or buy tokens in a market; this allows a user to be able to exchange one token for the other without the token's price taking a significant hit. This is why we hear of rug pulls. With rug pulls, it happens constantly because mostly the project owners are the ones who own a lot of the tokens and are essentially the ones who provide liquidity in the pool. So when this happens, the project owner either removes liquidity or sells a large number of tokens in his or her holdings essentially causing a hit in the price of the token. When this happens, it means that other holders of the token will be either left with cheap tokens to sell or will be holding tokens which cannot be sold in the market. This is something most people don’t understand when it comes to new and upcoming tokens. ### Zing Liquidity ------------- <center>  </center> --------- Out of all the four ways of earning zing, the liquidity pool is the one with the highest APR. The APR on liquidity is 465%. This is an awesome number considering that the next highest is posh holdings which is 271%. The thing about this APR amount is that it changes over time and usually, it falls drastically so it’s always good to get in first. If you don’t understand the risk with liquidity positions you’ll probably be thinking that the APR on liquidity is too high and shouldn’t be so. With liquidity, you get paid a share of a certain amount of zing over 24 hours unlike with delegation or posh balance where you get to claim staked zing over 1 or so hours. With zing, people who provide liquidity get to share an amount of 40,000 zing over 24 hours. So let’s say over 24 hours my share of the total amount of zing for liquidity providers is 20 percent, I get to take home 8000 zing. Yes, this is a huge amount but to achieve this you need to be providing a huge amount of liquidity to get to this. At first, this doesn’t seem worth it, but as I said over the long term it’s a good investment. ### How to add liquidity to zing: swap. hive pool ------------- Adding Liquidity on hive is not as difficult as a lot of people think. All you need to do is use the tools. You can either use Bee Swap or tribal Dex. In this tutorial, I’ll show how to use beeswap. Log into your beeswap.dcity.io with your hive keychain. After you log in, make your way to the pools option at the top right <Center>  </Center> After clicking on the pool side click on add liquidity <Center>  </Center> Search for zing:swap.hive at the search button and click on it. <Center>  </Center> Now at this stage, you can add to the pool. There are 2 spaces there, when you fill one the other automatically gets filled. This means there is a required number for each space you fill. Let’s say you want to provide one 1 hive some amount of zing tokens. It automatically tells you how much zing you need. This is why we call it a pair. <Center>  </Center> So opting for 1 hive against zing is 29.878. This figure changes. I remember when I was doing mine it was 1 hive to about 9 zing. ### Advantages of providing liquidity ------------ The advantage is that you get to earn fees when people use the pool. This fee is paid in liquid zing tokens. ### Disadvantages --------------- Some of them are for the first time you add it can take more than 24 hours for you to start earning but after that, it comes normally. When you want to take out your position you might not get what you place into the pool. I did 9 hive to about 90 zing but now if I want to remove my liquidity I’ll only get 5 hive to 168 zing. Even though the zing is uped I might not get what I put in there equivalent to dollars. In my opinion, liquidity is an interesting aspect of what we do. I think it’s important for people to have a clear picture of what they are getting into before they actually do. Hope this helps. <SUB>cover Image was made on canva</SUB> </div> Posted Using [InLeo Alpha](https://inleo.io/@rubilu/how-to-add-liquidity)

👍 ctptips, terraboost, tobias-g, high8125theta, crypt0gnome, sperosamuel15, cmplxty, ssiena, mercysugar, jimah1k, zzzinnn, yahuzah, zallin.pimp, depressedfuckup, abu78, dhedge, neoxiancityvb, abmakko, brofund-pal, iamrehan, zingtoken, wondex, sudeon, chesatochi, jmis101, good-karma, esteemapp, esteem.app, ecency, ecency.stats, auleo, cherryng, allentaylor, drwom, hurtlocker, photographercr, protokkol, tarabh, smariam, khadijaaya, waivio.welcome,