What Is Your Budget Principle?

money·@smaeunabs·

0.000 HBDWhat Is Your Budget Principle?

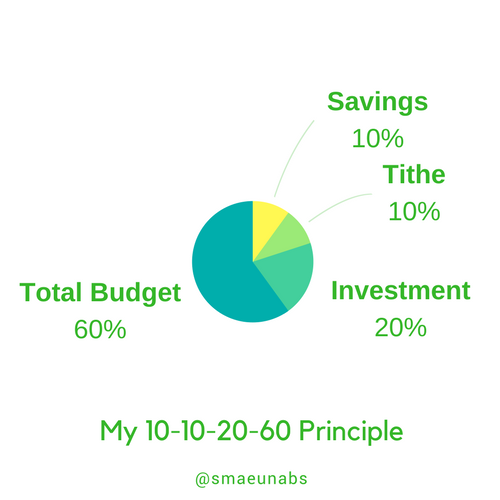

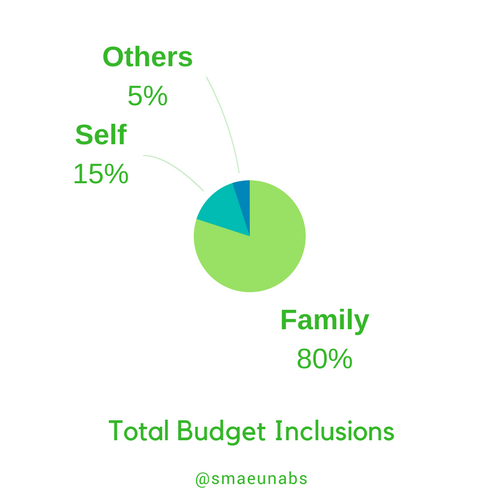

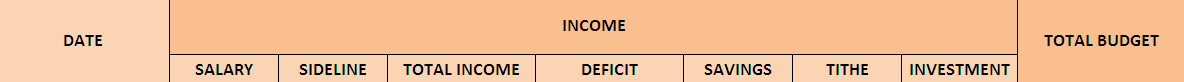

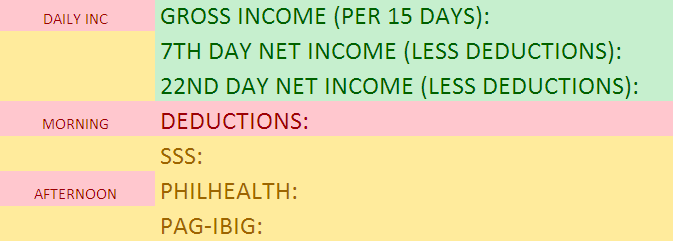

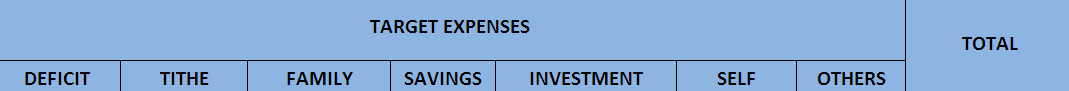

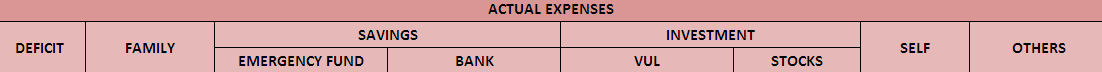

During my first year of being a working professional in a corporate field, I always stick to a budget plan every pay day. Having a budget plan really saved me from all the stresses of calculating and allocating my finances. <center></center> <center><sub>[image source](http://www.graystoneadvisors.com/aviation-budgeting-101-chart-accounts.jpg)</sub></center> If you’re a working professional, a home-based worker, a businessman, or even a student; as long as you’re earning, I suggest you to stick with a budget plan as well. This will help you manage your finances in a more structured and efficient way. Establishing a good budget plan can be stressful at times especially if you find it hard to define your financial scopes and priorities, but narrowing it down into a **Budget Principle** may be the key to categorize your finances. I bet you've heard about **10-20-70 Rule**; 10% for Savings, 20% for Investments, and 70% for Expenses, but what you are about to read is my personal budgeting style. You can always have it your own way that fits your financial priorities. <center></center> If there’s a 10-20-70 Budget Principle, I also have this **10-10-20-60 Principle: 10% for Tithe, 10% for Savings, 20% for Investments, and 60% for Total Budget Expenses.** - **Tithe.** *“Honor the Lord with your wealth and with the firstfruits of all your produce; then your barns will be filled with plenty, and your vats will be bursting with wine.”* - **The Principles of Plenty (PROV. 3:9–10).** Giving Tithes to the church is entirely up to you. For me, it is important to Tithe not just because it is stated in the Bible, but because our Spiritual Institutions need financial support for the continuity of Spreading the Good Word of God. - **Savings.** This includes my Emergency Fund and Bank Savings. I usually put half of my Emergency Fund in our Company’s Cooperative which is withdrawable anytime, and the other half of it is in my bank ATM. EF is solely for Emergencies, so I make sure to leave it untouched for unpredictable expenditures. Bank Savings, on the other hand is my personal Savings for the things I want to buy. I have this certain small goals to accomplish financially through planning. I usually don’t buy things I can not afford. I put my savings in a different bank account to separate it from my Emergency Fund. - **Investment.** This includes my VUL policy allocation (Life Insurance plus Stockmarket Investment), Cryptocurrency Investment (Yes, I used to cashin few months ago to buy Cryptos, but it stopped when I learned about Steemit), and Stockmarket Investment. - **Total Budget.** Finally, after prioritizing Tithes, Savings, and Investment, I am left with the Total Budget. This includes the budget for my family and for myself. <center>.png)</center> - **Family.** Since I am the bread winner of my family, a large portion of my income goes to paying bills, buying groceries, and family recreations. - **Self.** This is for the things that I want to buy for myself which include personal belongings and self-recreations. - **Others.** This is my personal allowance for work, transportation, and meals. ### Making sure that my 10-10-20-60 Budget Principle is attained ### Any Plan would be useless if it wouldn’t be taken into action. My way of realizing my budget plan is to make an excel with tabulated equations. This is divided into three parts: **Income, Target Expenses, and Actual Expenses.** <center></center> - **Know your Income.** Before I knew Steemit, my income mainly came from my salary. There were times when some of my friends pay me for commissioned portraits, so I consider it as a sideline. It is very important to know my income by assessing all the cash inflows that goes into my pocket in a half-month basis. Right now, I am considering 30% of my Steemit earnings as Income (the other 70% is for Crypto and Stock Market Investments). If you have noticed the **Deficit** tab, this is the portion where I ran out of cash before the next payday. I usually get it from my Emergency Fund from the bank. This tab will remind me that I still have to replenish what I've taken from my Emergency Fund. <center></center> <center><sub>This is made through an excel workbook. All of the values are tabulated with respective calculations.</sub></center> This is how I assess my semi-monthly pay. It is important to know your NET INCOME. When we say net income, we’re talking about the overall pay less all the deductions (SSS, Philhealth, Pag-Ibig). I formerly had a Tax deduction but because of the newly-approved Tax Reform Law here in the Philippines, I already omitted it. I also purposely put my daily income, and the income during half-days just in case I have unanticipated absences. This will help me foresee what my next pay would be. <center></center> - **Targeting Expenses.** This is the application of my 10-10-20-60 Principle. This is just connected to my Total budget income, so the values will automatically reflect as soon as I input my earnings. <center></center> - **Assessing Actual Expenses.** Of course, there are times when we exceed more than what we planned for. It is important to assess the difference between Target and Actual Expenses for us to reflect if we have attained our budget plan or not. Having a Budget plan will prevent you from spending more than you can afford. With consistency and perseverance, following such plan will instill financial discipline. It’s not about how big you earn, it’s about how well you manage it. If you can hardly manage with the little that you have, then there’s a great possibility for you to fail while managing the greater amounts that you will acquire. If you haven't created a budget plan yet, I hope sharing this will give you an idea. ### The biggest challenge is not creating a budget plan nor having a budget principle, but the consistency of sticking with it. # How about you? What is your Budget Principle? <center></center>

👍 strings, namranna, ybanezkim26, pz13, medinowski, linhlinhvictoria, yeisonrosello, paidsteemvoter, danialsmith, highclass, jesterking, rdef, gerardmacero, phopoen, nryn, akil-alam7, anupghosh, ez4me2c2, fojrance, edinso, labri, klasic, elijhacalling, wvoolrltl, ryeis1, aaryan, cocobeware, kirannew02, rapstar51, brywall91, jassennessaj, ja9garnett, annjadeadubo, rafael.espina, mjp, bayanihan, juvyjabian, marlon82, melvinlumacad, junivan2410, funtraveller, surpassinggoogle, southparkqueen, steemgigs, eurogee, kingyus, plojslydia, blogtrovert, ranielbrianulan, yanga, bollutech, suheri, bleepcoin, sndbox, zeppelin, leviticusjohan, smaeunabs, jcvertucio, akhris611, mindfreak, hansikhouse, sandbox, novale, animagic, voronoi, erb, indiantraveller, coquiunlimited, leotrap, pedrhenrique, idlebright, lgm-1, somethingburger, josh26, jayce17, arcange, caratzky, raphaelle, indayengineer, ozellequiamco, aljoursantillan, jonnahmatias1016, jhoy, henzkel, dioncrediblehulk, anmari, jmaeunabs1, nikkabomb,