Week #16 summary (April 17-21)

hive-167922·@solving-chaos·

0.000 HBDWeek #16 summary (April 17-21)

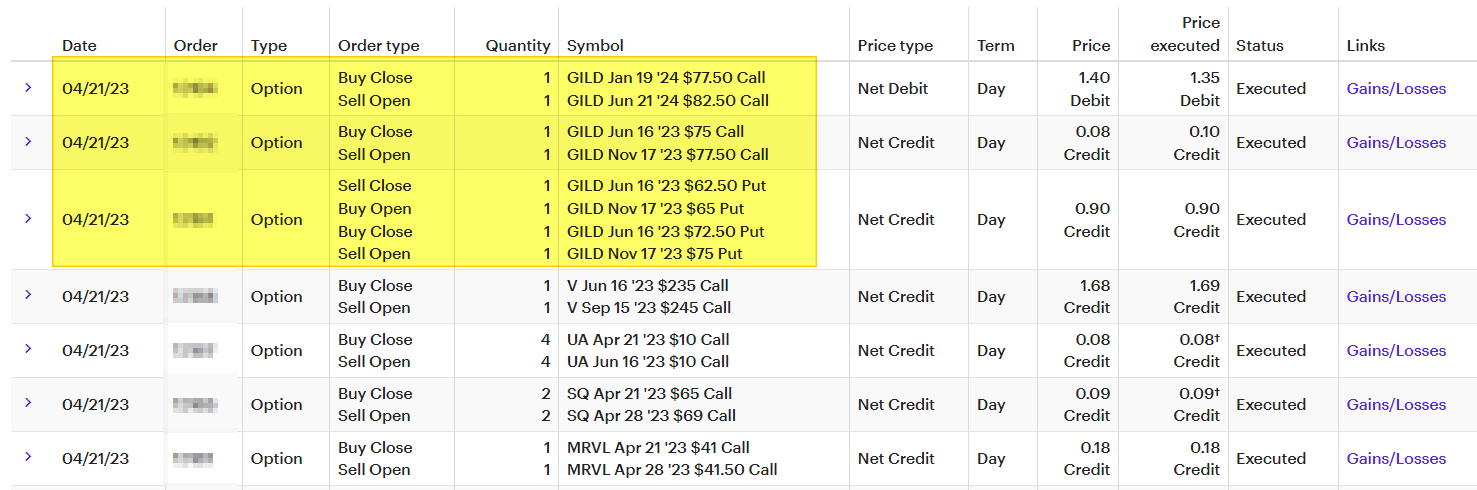

### Week #16 summary - Lost $100 in Options Trading last week for week #16. - 29 Trades - Fixing GILD Covered Call Trade with put credit spread. - Fixing Pivot Data - missing 3/10 Data. - "4-5-6" Social Media Option Portfolio for 2023. - Week #17 Dividend #### Lost $100 in Options Trading last week for week #16. Based on the data, I lost money again. The previous week was because I used $1600 to open a few LONG call positions on the BITCOIN move (which I believe will be upwards). This trade might take a year to play out.  This week was a different problem. I opened a covered call on GILD, and when a stock moves faster than you expect, your covered call WILL LIMIT your upside. This is a problem because you left money on the table. I used a Credit spread under the CURRENT market price to collect a premium to help pay for adjusting the COVERED CALL's Strike Price.  I spend $1.35 ($135) on the option to gain a potential of $5.00 ($500). In exchange, I added six months to the option contract. Then I collected $0.90 ($90) on the PUT credit spread to offset the cost. In options trading, sometimes doing NOTHING is worse than adding another TRADE to help reduce the "PAIN." #### Fixing Pivot Data - missing 3/10 Data. The other day I noticed that my table was missing one day of trading data. Im I had to go into ETRADE and copy the trades from 3/10. Before:  After:  That was +$600 of trading profits that I did not account for. #### "4-5-6" Social Media Option Portfolio for 2023. Here are the current YTD returns for SPY using 4-5-6 contracts.  Since I opened some of these contracts 90+ days before expiration, we are entering the "zone" where you can see the profits/losses reflected on the options. The slow THETA (time) DECAY, when there is between 70-120 DTE (days until expiration), can be offset with the move in the underlying price. My next Iron Condor is the SPY for June 16 (which is now less than 60 days away). If SPY stays far away from the SHORT LEG of the trade, you will see the option's value dropping faster now. If SPY trades near the "midpoint" of the two short legs (put vs. call legs), neither side of the option will be "TESTED" and the value will move toward zero. This is the optimal situation for an iron condors trade. Remember you don't need to wait until June 15 or 16 to close the trade. I can close anytime, but I wanted to wait until I made a decent return on this trade. Closing too early might only result in a $3 or 4 profit. Closing too late might increase the risk should the option be tested. During March/April, my CALLS were tested because I used a 440 as my SHORT CALL leg. * Date / S&P 500 * Mar 22 = 3,936.97 Apr 03 = 4,124.51 Apr 13 = 4,146.22 Apr 18 = 4,154.87 *** Here is what the position looks like on the morning of 4/24:  As you can see, this will cost me $0.91 to close the position today (which is a profitable trade for me). If possible, I want to close it at under $0.80 or $0.70.  ### Week #17 Dividend This week's passive dividend is expected to be around $12. Anything is better than nothing, and my goal is not to build a dividend portfolio since I'm still in the **ACCUMULATION** mode. Once I'm closer to retirement, you can shift more of the portfolio to passive income. I'm still looking at GROWTH and adding in riskier investments like BITCOIN because I'm still 10+ years away from retirement.  Regards, Solving-Chaos Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@solving-chaos/week-16-summary-april-17-21)