Week 25 - June 21 Option Trades

hive-167922·@solving-chaos·

0.000 HBDWeek 25 - June 21 Option Trades

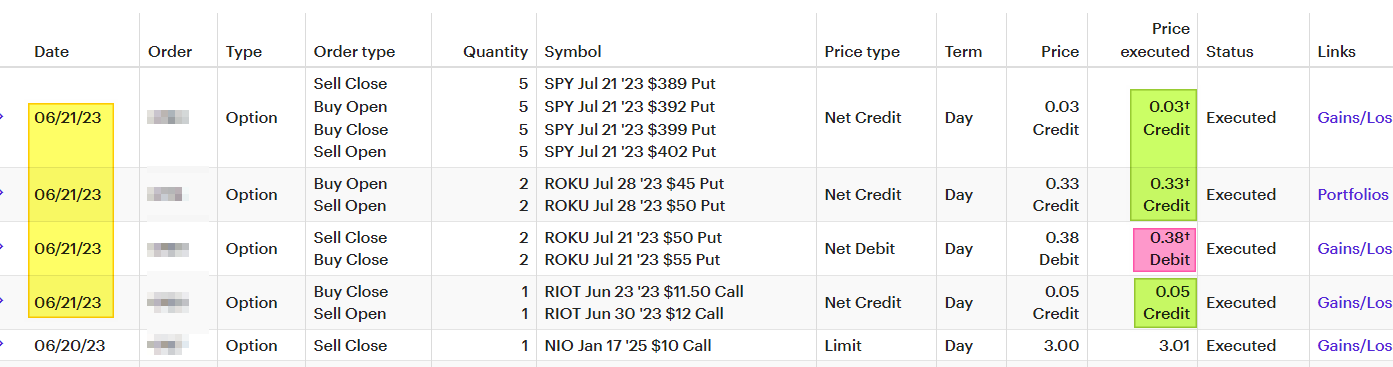

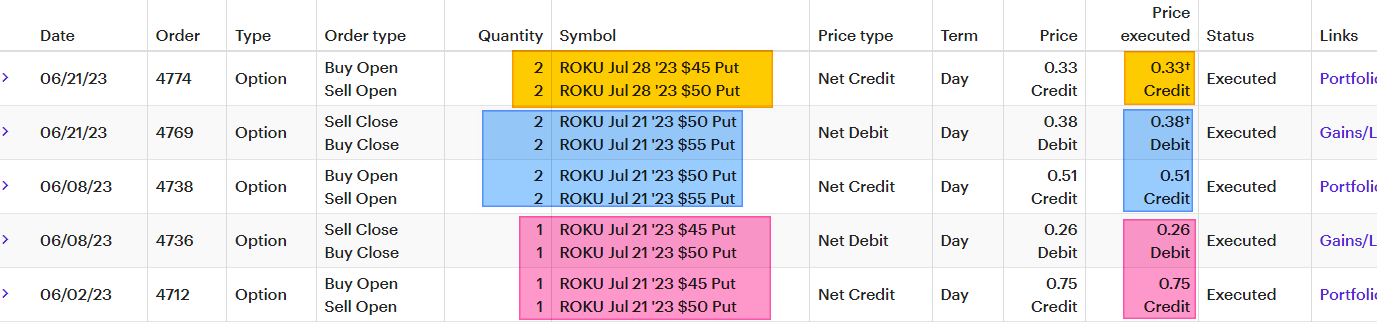

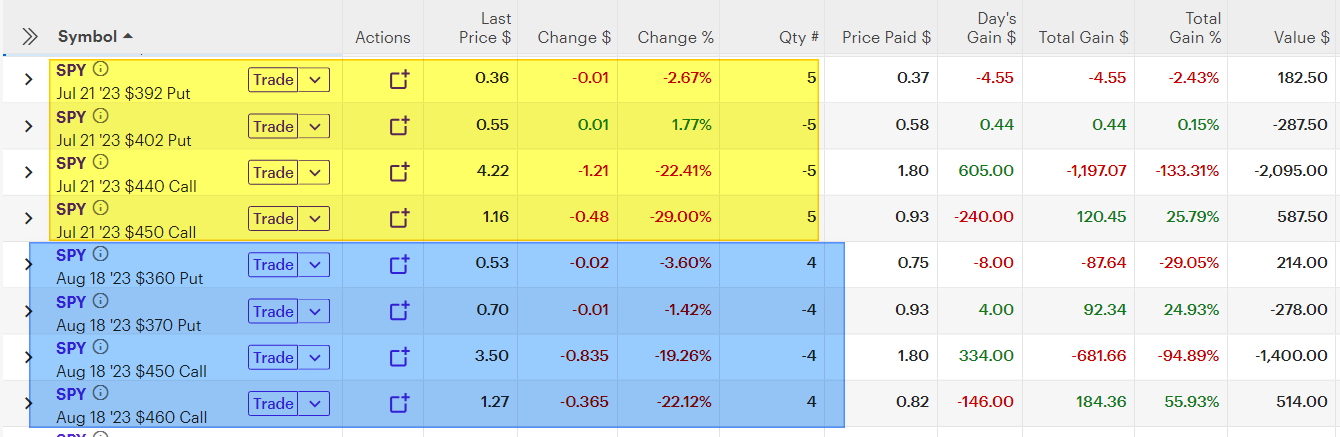

## Week 25 - June 21 Option Trades - June 21 Trades - ROKU Trades (Historical data) - SPY Moves (losing positions) - One Positive with recent RED MARKETS. - My goal for this week: #### June 21 Trades Here are the trades for today. Based on this view, it appears I made nothing today. Even if this is true, why would I do this trade?  #### ROKU Trades (Historical data): I closed the July 21 ROKU Put Credit spread. I opened a new July 28 Put Credit Spread using a strike price that is $5 lower (less risk). I locked in my profits on ROKU (JULY 21) and opened a new position using LESS RISK.  I bet that this risk will still be profitable, even if the market decide to turn RED going forward. #### SPY Moves (losing positions) I still adjusting my Iron Condor on SPY - adding risk to the PUT legs. However, we are just only 2 days into this RED MOVE, so I need to consider what happens if S&P500 rebounds above 440!  At this point, I will still lose money in my current IRON CONDOR position. By adding some risk, I trying to find the right balance by collecting some premium to offset what my losses will be. The perfect exit would be the market stay between the range with little time left on the options contracts. Then I can exit this trade with a profit. However, I don't believe that will happen. I need to look for an exit point at some point and move on to the next trade. #### One Positive with recent RED MARKETS. When markets switch from GREEN to RED, it pivots what winning trades look like. In the last 3 or 4 weeks, several covered calls moved ITM (In-the-Money). This forces me to roll UP (strike price) and OUT into the future (time).  Now that the markets are RED the last few days, it creates some room for the covered call to be adjusted for more premium going forward. This is true when the current market price is under the STRIKE price of the option (Covered calls). #### My goal for this week: My goal is to always make money from a week-to-week point of view. I will roll-covered call UP and Out when I can. This will create a bigger gap between the market price and the CC's option STRIKE PRICE. The SP500 Iron Condor is what I watching more closely. If the market drops 3% or more in a single day, it could force the PUT legs to be losing money. I need to exit these risky positions soon, but I will wait and look for an opportunity to do so. Time is always decaying so if markets are "flat", then I can wait before I CLOSE my position. My dividend has little impact on my portfolio this week.  Have a profitable day, Solving-Chaos