23. Blockchain regulation versus innovation in the EU - 3.1.3

law·@sorin.cristescu·

0.000 HBD23. Blockchain regulation versus innovation in the EU - 3.1.3

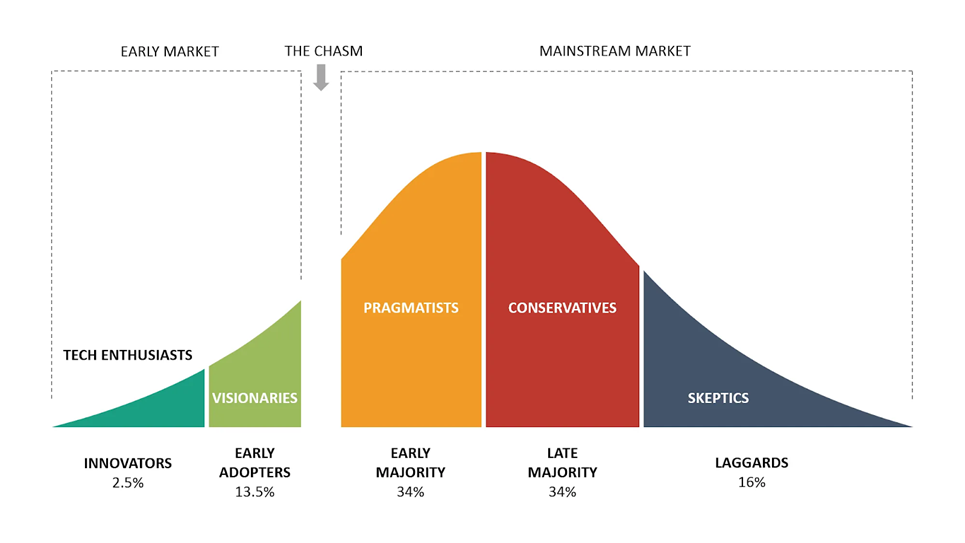

### 3.1.3. Crypto-asset-linked actors have now a law to abide by -14. As explained in Part 1 and underscored again in the previous section, **crypto-assets are primarily an institutional and economic (rather than technological) innovation**. Yet the peer-to-peer “crypto-economies” are still small and poorly integrated with the traditional economies, built in a legal framework which consecrates the role of financial intermediaries. It is precisely **the power and economic rents of these intermediaries** that **the blockchain innovation most threatens**, and it is thus to be expected that they will fight against it tooth and nail. -15. It is useful in this context to assess the situation through the prism of **game theory**, and specifically the “Prisoners’ dilemma” game mentioned in Part 1 par. 26 and illustrated in Figure 1. Against the threat of a disruptive innovation, any individual financial actor can hope to reap the benefits of the **“first mover” by “defecting”** (or “confessing” in the terms of Figure 1.), i.e. acting as a bridge allowing the retail consumers to interact with an otherwise isolated and hard-to-reach offer. But since they owe their power and economic benefits to existing laws and regulations, it was easy for them to **“cooperate”** (or “remain silent” in the terms of Figure 1.), without a need to actively coordinate, as long as crypto-assets were “outside of the legal framework”. Subsequently, in most European countries innovative start-ups would see their **demands to open a bank account refused** by incumbent banks as soon as the words “blockchain” or “crypto” popped up in the documentation submitted. -16. With MiCA, and especially once the ESMA and EBA regulatory technical standards and guidelines reach the financial actors, **the risk of forgoing good business opportunities to rivals** who take the jump and develop a line of services to crypto-asset companies **increases significantly**. As compliance departments gradually incorporate the new rules in their books I expect a tipping point to be reached. Dabbling in crypto-assets should not be a suspicious behavior anymore, as there is now not only a “profit and loss” to look at, but also a law against which the seriousness of the actions can be judged. -17. In a recent article on the topic which I quoted previously, Patrick Hansen expects MiCA to “**lead to more institutional adoption and activity in the EU crypto market**” , especially since 60% of investment managers recently surveyed had cited “regulatory uncertainty as a barrier to greater crypto adoption in portfolios” . As is often the case when new EU regulations enter in effect, it is likely that the “Big Four” consulting companies will play an essential role **devising and offering to the financial institutions “turnkey” business processes tailored to MiCA’s provisions**. -18. Moreover, it should be noted that **the potential addressable market was and is still small**, as the crypto-asset innovation has not yet managed to “cross the chasm” and is still confined to “innovators” and “early adopters” . The **biggest promise** implicit in MiCA is that, once the traditional financial institutions deploy crypto-asset services for their retail customers, **blockchain and crypto-asset innovation will become accessible to the mass market**. <sup>**Figure 6.** MiCA could well prove a successful bridge helping the consumers to "cross the chasm" - image from the "[diffusion of innovations](https://michael-levin.medium.com/part-2-lightning-network-bitcoins-crossing-the-chasm-superpower-7fe4fd4702dc)" theory of Geoffrey Moore</sup> -19. In this chapter, I presented **the main sources of criticism toward blockchain and crypto-asset innovation** and noted that **MiCA addresses them**, using an evolutionary approach similar to how the Union legislation deals with risks and challenges in the area of traditional finance. In so doing, it explicitly **includes crypto-assets in the sphere of Union regulated activities and thus legitimizes them**. -20. In the next chapter, I will specifically explore MiCA with the eyes of a traditional financial actor. --- | [Table of Contents](https://ecency.com/law/@sorin.cristescu/1-blockchain-regulation-versus-innovation)|| |---|---| |[<previous\>](https://ecency.com/law/@sorin.cristescu/22-blockchain-regulation-versus-innovation-in-the-eu-312)|[<next\>](https://peakd.com/law/@sorin.cristescu/24-blockchain-regulation-versus-innovation-in-the-eu-321)| [186] P. Hansen, “The EU's new MiCA framework for crypto-assets - the one regulation to rule them all”, op. cit. [187] The Bitwise/ETF Trends 2022 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets, 2022 https://static.bitwiseinvestments.com/Research/Bitwise-ETF-Trends-2022-Benchmark-Survey.pdf [188] G. Moore, “Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream”, Harper Business Essential, 2014

👍 pboulet, joeyarnoldvn, rbm, tobetada, flyinghigher, steelbak, modestscavo, vonaurolacu, journeyofanomad, borniet, gloriaolar, alexvan, laruche, walterjay, felt.buzz, zonguin, aidefr, sorin.cristescu, robotics101, hivequebec, nopasaran72, svanbo, pollux.one, jga, lemouth, littlescribe, lpv, ezzy, exyle, steem.leo, mice-k, dcityrewards, roxane, steemituplife, felander, accelerator, unconditionalove, themightyvolcano, nateaguila, cakemonster, goodcontentbot, triplea.bot, beta500, therealyme, ribary, dpend.active, netaterra, bengy, a-bot, drricksanchez, masterthematrix, yogacoach, dbddv01, holoferncro, zugs, eforucom, supu, francosteemvotes, unpopular, evildido, revueh, voxmortis, forykw, forkyishere, orkangel, pladozero, friendly-fenix, bluelightning, doomsdaychassis, heros, sorin.lite, luciancovaci, shanibeer, cryptogeek2020, catotune, borjan, gribouille, drsensor, iuliana.lux, lux-witness, pstaiano, alexdory, acasas, vianney, catotenor, cubapl, markegiles, eosdios, pazartesi, psyskiff, felixxx, awildovasquez, addnode, gadrian, imbartley, statorcrime, steemmillionaire, kriszrokk, deepresearch, techguard, hive-lu, altonos, almi, zuerich, manniman, i-test-stuff, rafzat, treetoptennis, honeydue, rmach, oneshot, themonetaryfew, edith-4angelseu, hive.samadi, atego, drlobes, preparedwombat, nave7, davidxxl, alfazmalek02, princewaqar, mao317, christybliss, harryji, anthonyadavisii, johnattahekom, ahlawat,