Ray Dalio's All Seasons Weather Portfolio for Investing

money·@stevesprinciples·

0.000 HBDRay Dalio's All Seasons Weather Portfolio for Investing

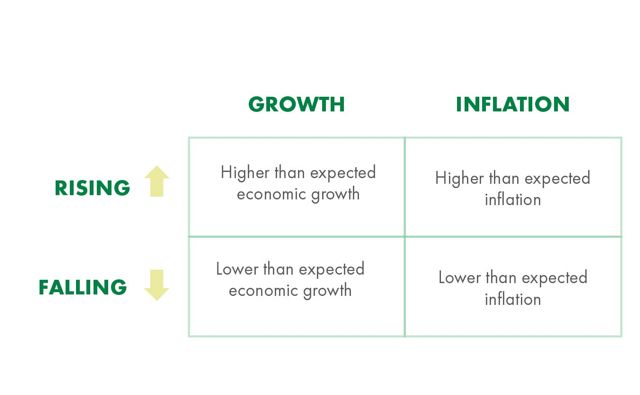

Hey guy :) If you read Tony Robbins Money Master the Game or Ray Dalio - Principles books you will hear they talk about an All-seasons portfolio. An investment portfolio that is able to weather all seasons of the economy. to understand a bit more about the "Seasons of the economy" see my other article on What are the Seasons of the economy for investing. Here I give a brief example of a portfolio that I made going off the general basis of this principle. By no means do I expect this to be a bullet proof portfolio. This portfolio has the structure of being safe, but, also due to my age/risk level/experience level, I altered it a tiny bit for a bit more growth potential. This is just to show you to give you an idea. I am sure there are many better ways to create a portfolio like this! Have fun!  Asset Allocation My All Seasons Portfolio Bond’s 1. Government Long-Term Bond ETFS (15% of Portfolio) • BMO Long Federal Bond Index ETF: ZFL 0.43% fees, 2.99%yield, avg.22yrs, CDN federal bonds long term • iShares Core Canadian Long Term Bond Index ETF: XLB (10%) 0.38% fees, 3.52%tyield, avg. 22years, CDN government bonds, 400+. 2. Government or Corporate Intermediate & Short-Term Bond ETFS (25% of Portfolio) • BMO Aggregate Bond Index ETF: ZAG (10%)0.23% fees, 2.93%Tyield, avg. 10yrs, mixed diversified CDN Gov. Bonds & 30% corporate. 10 holdings (other BMO bond etfs) • iShares U.S. IG Corporate bond Index ETF: XIG (10%) 0.6% fees, 3.17%Tyield, avg. 10yrs, 1000+ US corporate bonds, CAD hedged • iShares J.P. Morgan USD Emerging Markets Bond Index: XEB (5%) 1.05% fees, 4.11%Tyield, avg 11yrs 30+ sovereign debt of emerging market countries, CAD hedged Stock’s, Gold & REIT 3. Domestic Stocks: (20% of Portfolio) • S&P 500 index ETF: VFV (5%) 0.16% fees, 1.6%Tyield, P/E 21.5x • Berkshire Hathaway: BRKB (10%) 0% fees, USD, 0%yield, P/E 20x • CIBC Bank (Dividend) (5%)0% fees, 4.7%yield, P/E 9.2x 4. International/ Emerging Market Stock/ Global Stock ETF’s (10% of Portfolio) • FTSE Developed All Cap ex North America Index: VIU (5%)0.43% fees, 2%Tyield, P/E 17x • FTSE Emerging Markets All Cap index ETF: VEE (5%) 0.47% fees, 1.9%Tyield, P/E 14.5x 5. Sector & Specialty ETF’s (5% of Portfolio) • Riocan Real Estate Investment Trust: REI-UN.TO (2.5%)0% fees, 5.94%yield, P/E 10.86x • Chartwell Retirement REIT: CSH-UN.TO (2.5%) 0% fees, 3.79%yield, P/E 8.6x 6. Commodities (5% of Portfolio) • IAU iShares Gold Trust - Gold bullion holding (5%) 0.25% fees, Doubled Profit from 2008-2010.. up 10% YTD. (price increases during economic crisis) 7. Personal Investments (20% of Portfolio) • Millennial E Sports • Cryptocurrency (Bitcoin, Ethereum, Litecoin, Altcoins) • Alibaba 0% fees, 0%yield, P/E 60.68x (up 100%YTD) • Apple - 0% fees, 1.57%Tyield, P/E 18.47x, Cash Reserve $256Bn.