ETHEREUM SELL - Ethereum troubles provides us with a trade - current price $269.25, 1 July 2017 @supertrader

ethereum·@supertrader·

0.000 HBDETHEREUM SELL - Ethereum troubles provides us with a trade - current price $269.25, 1 July 2017 @supertrader

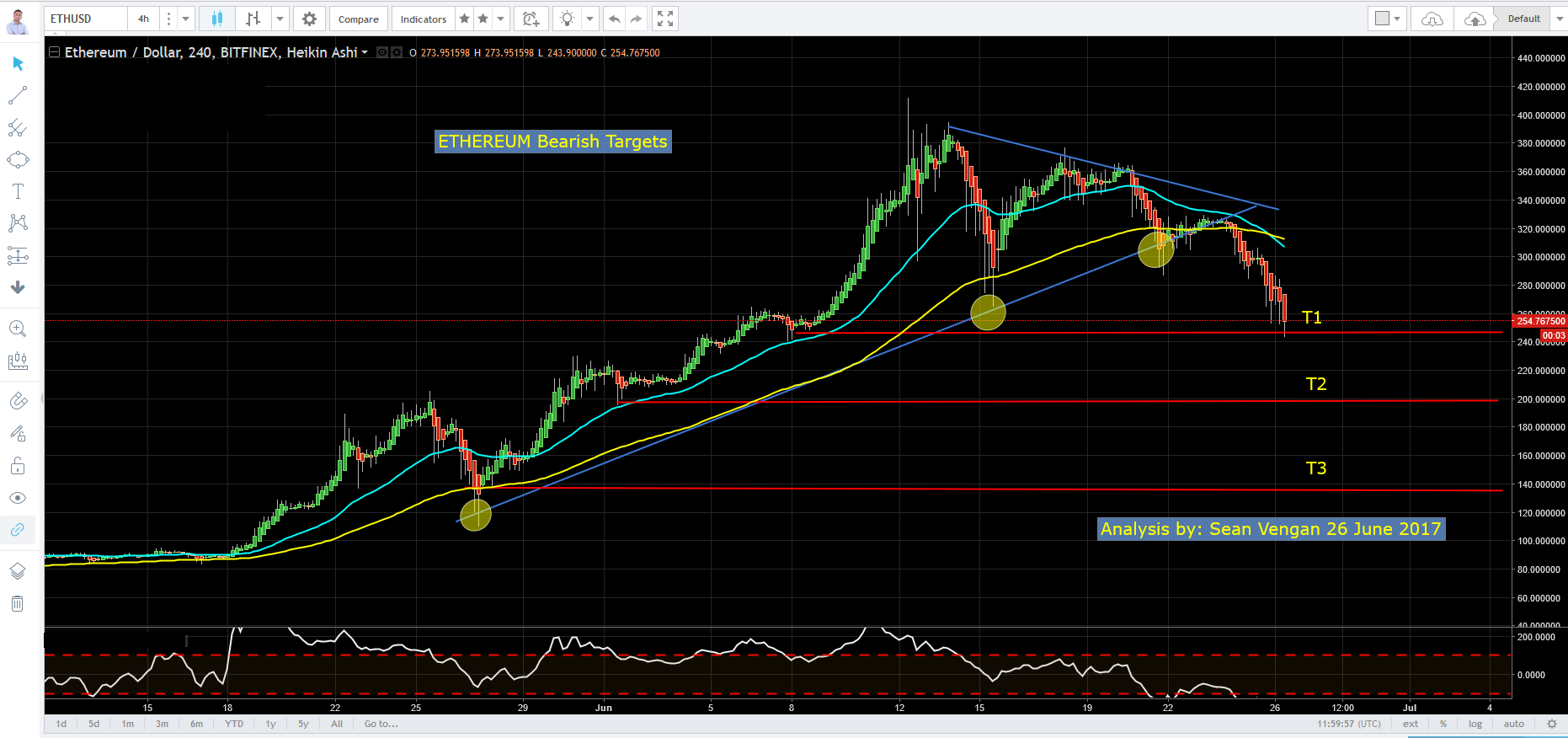

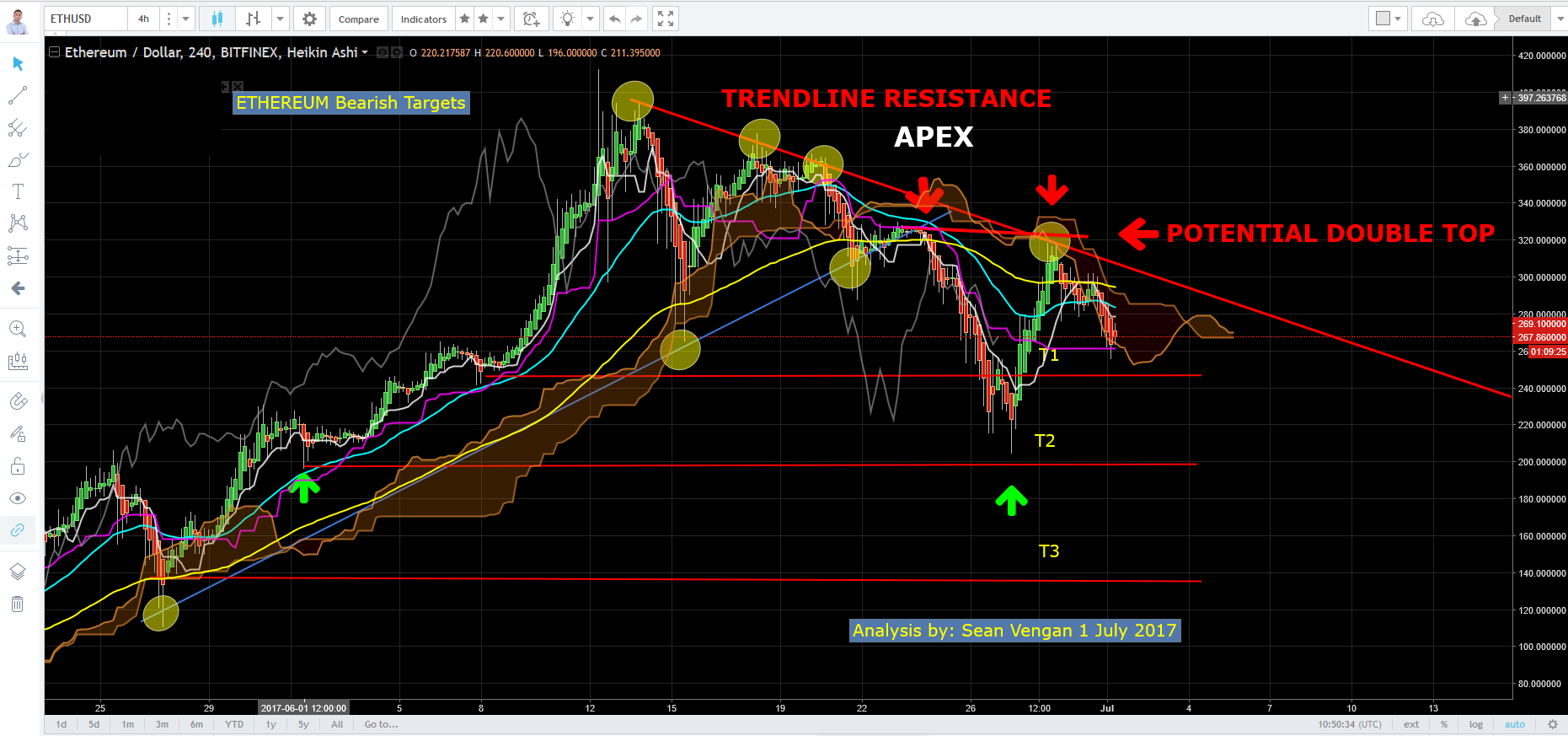

*** please RESTEEM and VOTEUP if you like this post *** Five days ago, on 26th June 2017, I forecast in advance (not in hindsight, as many "so called gurus" do), that you should consider going short on Ethereum and I supplemented this, as always, with my professional trading advice on risk management, giving you specific entry, price targets and stop loss. Here was the chart 5 days ago... To have a larger view of the chart, just right click on the chart image and select "View Image"  And below take a look what happened, it turned out to be a great trade - we safely hit Target 1 (T1) and fell ever so slightly short of Target 2 (T2). Had you managed this trade, with a trailing stop loss, you would have made good money. Well here's the thing... we now have a 2nd chance (double dipping). Let me explain... To have a larger view of the chart, just right click on the chart image and select "View Image"  Just like the current Bitcoin chart, as of todays writing, we can see from the Ethereum chart that an Apex formed, but 5 days earlier than where Bitcoin is now. In my last post today (1st July 2017), I explained giving you a live real example of the current Apex trade setup playing out in Bitcoin: https://steemit.com/bubble/@supertrader/pop-can-you-hear-it-that-s-the-bitcoin-bubble-bursting-current-price-usd2-502-01-1-july-2017 Fortunately, we can see the value of this strategy by looking at what happened on Ethereum, 5 days after the Apex occurred. It plunged hitting T1 and almost hitting T2, this was followed by a strong rally, as it bounced back up, but BAM ! it hit heavy resistance again, at a previous top around $320, unable to break higher. For you fundamentalists out there (which in this crypto market it is advaisable to stay in tune), Etehreum has had major problems recently. Of most significance, is that the Ethereum blockchain simply couldn’t accommodate this global interest it has received. The Merkle writes, in its article entitled "Status ICO Highlights Inherent Flaws of Ethereum’s Blockchain and MyEtherwallet", on 21 June 2017: "...people started sending large amount of Ether well in advance. All of these transactions were rejected of course, yet it caused a lot of overload for the Ethereum blockchain. Despite what some people may think, Ethereum’s blockchain does not handle large amounts of transactions all that well. Eventually the network block was reached." We as traders don't actually need to know all these fundamental problems, as the price charts tells us everything. By training our eyes, we can see clearly from this price chart that the price was meeting RESISTANCE - we have no need for news reports or live TV broadcast. The charts tell us everything- so you can switch off your CNBC tv. I am now anticipating it's game on again for our shorts and once again we can follow the entry, targets (T1, T2, T3) and stop loss I have already provided for you. Hope this helps. Analysis by: Sean Vengan 1 July 2017 If you like this post, you know what to do VOTE IT UP, RE-STEEM and FOLLOW ME, you get paid just for voting or commenting and I get paid for my time. If you are interested in learning how to trade in this exciting new cryptocurrency market, from a 10+year Veteran Trader, I would love to share my knowledge, experience mistakes and journey. The trading value I can offer you covers: - PROFESSIONAL STRATEGIES - RISK MANAGEMENT and - TRADING PLANS These strategies will EMPOWER you to trade ANY MARKETS - Forex, Stocks, Futures, Options, ETFs If this of interest to you, then register your interest with my site I would be privileged to educate you. Website : http://cryptotradingmastery.com/ YouTube: https://www.youtube.com/playlist?list=PLn7YikUv2BchBGW8Gza0o6uOPAb3Sop9Z