Out of the Nest

hive-167922·@tarazkp·

0.000 HBDOut of the Nest

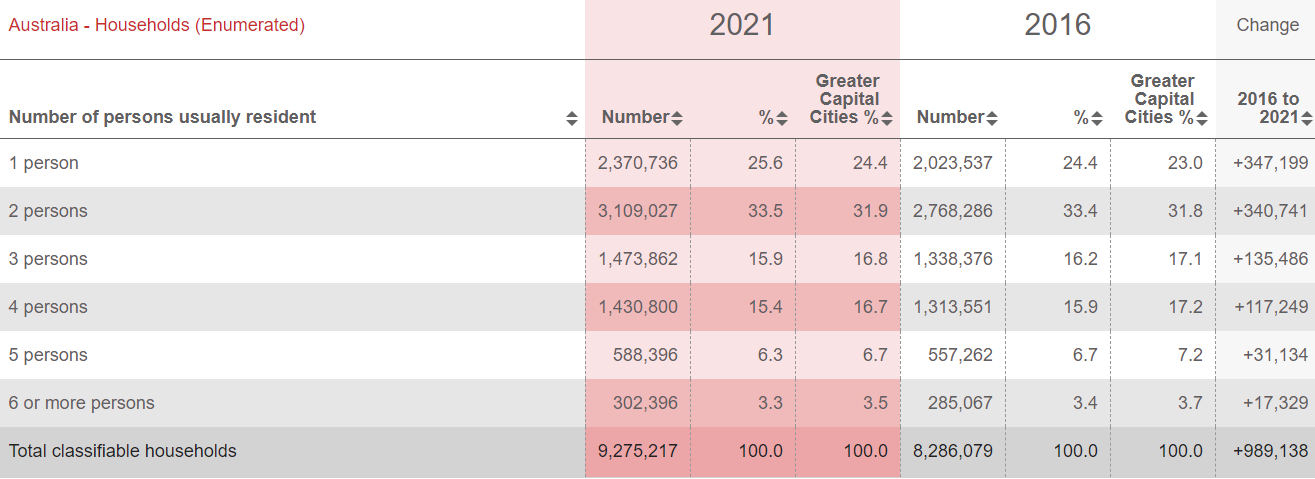

<div class="text-justify"> I remember taking this shot, although it must be from about a decade ago. It was sitting on an old tree stump, as my then-fiancé and I walked from the train station to Bakken in Denmark, the oldest amusement park in the world. The idea of a "nest egg" came to mind, though at the time I wasn't writing anything at all.  I remember an old bank advert from back in Australia, where there was a golden egg sitting in a nest, talking about retirement. At the time, I wasn't thinking that much about retirement at all, though a couple of my teachers (both math teachers) had gone through the calculations as to how much they would need in the bank to be able to retire, and comfortably live off the interest. It was around a million dollars at the time, because that would have attracted around *eight percent* interest, so after tax, around 50k a year. That was about 20-30 percent more than a teacher was getting at the time, before tax. I was reading a story today that was talking about how expensive life is in Australia, where some people who are earning 200,000 a year as a family, are struggling to do more than "live" with their income. One was saying that their mortgage was 12,000 a month. > How things have changed. To cover just the mortgage, a person would need to have to have 5 million in the bank to have the interest pay it off. Factor in the cost of living, and they might need another four or five million to live fully off the interest. Whilst that is around 10x the amount, the average salary has only doubled in that time frame. A lot of people don't seem to understand why wages have grown so slowly in comparison to the costs of living, but it is pretty obvious when you think about it. Percentage wise, there are more people working than there were fifty or sixty years ago, and the types of jobs we are doing have changed. There are obviously a lot more women in the workforce, so there are more two income families. But, demand doesn't increase that much on many goods and services for a family, despite there being two incomes, so prices can increase and soak up the "excess" from households until an equilibrium is reached. This means that wages don't increase as fast as the cost of living. But, culture has also changed, which means that there are a lot more single people, living in a high-cost environment, and that creates additional problems. For instance, there are increasing pressures on housing availability in many countries, and many blame immigration, which is part of the issue, but it is more than that. This is a chart of "single person households" in the US since 1960:  That is quite a massive increase of around 500%, but the population of the country has only doubled in that same time span. And, it is similar in Australia, where just in the five years from 2016 to 2021, the total number of households increased by almost a million.  But with declining birthrates, it is in the 1- and 2- person households that there are the largest increases by far. This means that in those five years, just in the single person households, an additional 350,000 residences were in demand. Factor in divorces, another cultural change over the last 60 years, and it is pretty obvious that there are more factors in play than immigration. Immigration is just another stressor on top, and remember that the numbers that they report in the news, are total migration, including temporary visas, which make up about 75% of the migration. Of course, people on temporary visas need a place to stay too. And then on top of this, take a look at the average household spending compared to that of a couple generations ago. Back "in the day" there were no subscriptions, very little entertainment, very few travel vacations and most of what was spent, was spent on something tangible. Now, a lot of the monthly spending goes on digital life, gadgets, services, applications and access. And, most of that kind of spending returns nothing we can trade, it doesn't increase the value of our house, it doesn't improve our skillsets to earn more, it isn't an investment. It is just a monthly expense. And, on top of this, the tangibles have increased too, where more people are buying "stuff" on terms, whereas in the past it was just a house on a loan. Spending debt on cars, electronics, holidays, clothes, and whatever still fits on a credit card, means that servicing loans is an increasing percentage of outgoing money flows, which over time *reduces* spending. When it comes to building a nest egg for retirement, the most important part of it is to go in *debt-free,* so that there are no ongoing obligations. In the past, this was easier, because there was not only more purchasing power for the dollar, but also less to spend the dollar on. This meant that a lot of people either paid off their mortgage, or saved their money with a decent interest rate, so it was working for them, just collecting in the background. So when they retired, they had their house covered, no debt, and a lumpsum in the bank, still earning, eve without investing into something like the stock market directly. The fact for most people is, it is impossible to maintain the current lifestyle most are living, *and* build an adequate nest egg for retirement. Like it or not, people generally have to choose which is more important to them, the lifestyle in the moment now, or the lifestyle over the course of their entire lifetime. For many, they are choosing the now approach, because the future approach doesn't come with a dopamine boost. I was talking to a new colleague the other day, an ex-pat Australian living in Europe, and he has been shocked when he has gone back to Australia on holiday as to the change in prices. He lives and earns in one of the most expensive countries in Europe, but he wouldn't shop in Australia. However, when he didn't buy some boots because they were too expensive, his sister said "just put it on the credit card". It is this mentality that is holding so many people back. When prices went up in the past, people would cut back their spending, but now, they increase their debt. This leads to a *very different* outcome over time, as that debt service becomes spending, meaning that not only can't you buy what you want, you have to pay more for what you have already bought, and likely already forgotten. The global economy is not only broken, it is on the precipice of collapse, and perhaps we have to let it collapse to learn *another* lesson about economics. But, if we want to build something better, we have to actually do something different, and stop relying on debt to maintain our lifestyles and instead, restructure our lives so that we have the habits that generate value, not bleed it. Bakken might be the oldest amusement park in the world, but in recent years, there has been a massive shift in how much we spend on entertainment, and the things that make us "feel good" in the short term. Yet, how are we feeling a little bit later, when interest rates are rising, cost of living is rising, and we are unable to make ends meet? They say, don't put all your eggs in one basket. But I would add, especially if that basket has no return value. Taraz [ Gen1: Hive ] </div> Posted Using [InLeo Alpha](https://inleo.io/@tarazkp/out-of-the-nest)

👍 gaottantacinque, netaterra, cribbio, drax.leo, gasaeightyfive, bruleo, rbm, babytarazkp, liaminit1, keys-defender, joeyarnoldvn, khalneox, therealyme, netaterra.leo, drricksanchez, scooter77.pob, drexlord, cryptoshots.nft, nakary, tsurmb, marcocasario, coffeea.token, crypto-shots, condigital, mciszczon, chucho27, sumatranate.leo, rdfield, dutchchemist, hive-defender, cryptoshots.play, cryptoshotsdoom, subhari, jkp.nisha, sumatranate, d-company, khalpal, jontv, xkasabian, fee-service-new, noloafing, cst90, bearjohn, zuun.net, g4fun, rmsadkri, xyz004, pero82, ew-and-patterns, mrsbozz, tipsybosphorus, nichemarket, instytutfi, cryptoandcoffee, tamiapt6, philnewton, src3, iamfarhad, sahil07, abh12345, jayna, abitcoinskeptic, lestrange, mattbrown.art, allover, rituraz17, fknmayhem, pcojines, janitzearratia, yousafharoonkhan, shanghaipreneur, superlao, ghazanfar.ali, bastter, crookshanks, digital.mine, kgakakillerg, photosnap, bozz, kgsupport, mangos, sbi6, kendewitt, chinito, iikrypticsii, hive-117638, brutus22, sbi-tokens, intrepidphotos, ezzy, exyle, steem.leo, mice-k, dcityrewards, mjvdc, unconditionalove, dpend.active, sharmbabe, mobbs, bigtom13, zemiatin, simplifylife, alg-nftgaming, mytechtrail, thgaming, teamaustralia, dynamicrypto, abdulmath, seattlea, senseisar, kraaaaa, beffeater, wahlterwhite, braaiboy.pgm, gringo211985, lermagreen, socialmediaseo, theluvbug, tryskele, zaddyboy, psyberx, technologix, psx-bank, denizcakmak, travelpic, r-nyn, psyberfish, psybercurator, abcor, cards4rent, patronpass, celestal, jim-crypto, riz611, jhelbich, cyclope, agustinaka, belemo, kurkumita, joshman, belemo.leo, nanzo-scoop, cconn, darkpylon, mummyimperfect, ak2020, emily-cook, t-bot, mafeeva, scoopstakes, nanzo-snaps, kgswallet, balvinder294, espoem, pappyelblanco, xrayman, feanorgu, macchiata, joseda94, abrahan414, drax, abh12345.leo, meesterleo, preparedwombat, freebornsociety, fulcrumleader, forexbrokr, smartvote, danewilliams, crypto-guides, maryjane.main, morzex, deviliclucifer, becca-mac, leetalks, owasco, markegiles, meowcurator, officialhisha, eddie-3speak, contapoupanca, tamaralovelace, galenkp, lanzjoseg, coinjoe, galenkp.aus, hive-168869, mrbonkers, crazydaisy, blind-spot, hive-lu, gollumkp, cmplxty, ssiena, bitcoinflood, astrolabio, celestegray, nthtv, brucegryllis, liseth.zamora, ileart, vcclothing, mulik369, valggav, jane1289, dadapizza, jokinmenipieleen, chrysanthemum, leophile, kaerpediem, fieryfootprints, urrirru, ak08, outwars, holdonla, jfang003, shanibeer, ladyrainbow, goldgrifin007, acidyo, gniksivart, holbein81, worldwildflora, bigmoneyman, ghaazi, leveluplifestyle, mdasein, alphacore, dejan.vuckovic, xves, rendrianarma, supreme-verdict, devpress, thegrandestine, the-reaper, ninnu, meltysquid, jerge, revise.leo, dashroom, not-a-bird, not-a-gamer, rafzat, ahmetay, deadswitch, artlover, vcelier, dandays, inpursuit, pursuant, honeydue, storiesoferne, photographercr, cowboyphylosophy, relf87, goddesseva, agmoore2, wolfplayzor, fw206, edicted, iansart, gogreenbuddy, anonsteve, hextech, gloriaolar, tarabh, ablaze, behiver, arcange, achimmertens, shainemata, laruche, walterjay, aidefr, robotics101, hivebuzz, steemitboard, marivic10, lizanomadsoul, manncpt, jnmarteau, crypticat, egistar, selftheist, p1k4ppa10, thebigsweed, planetauto, rynow, trumpman2, oelgniksivart, amiegeoffrey,