Supercharger on Loan

hive-167922·@tarazkp·

0.000 HBDSupercharger on Loan

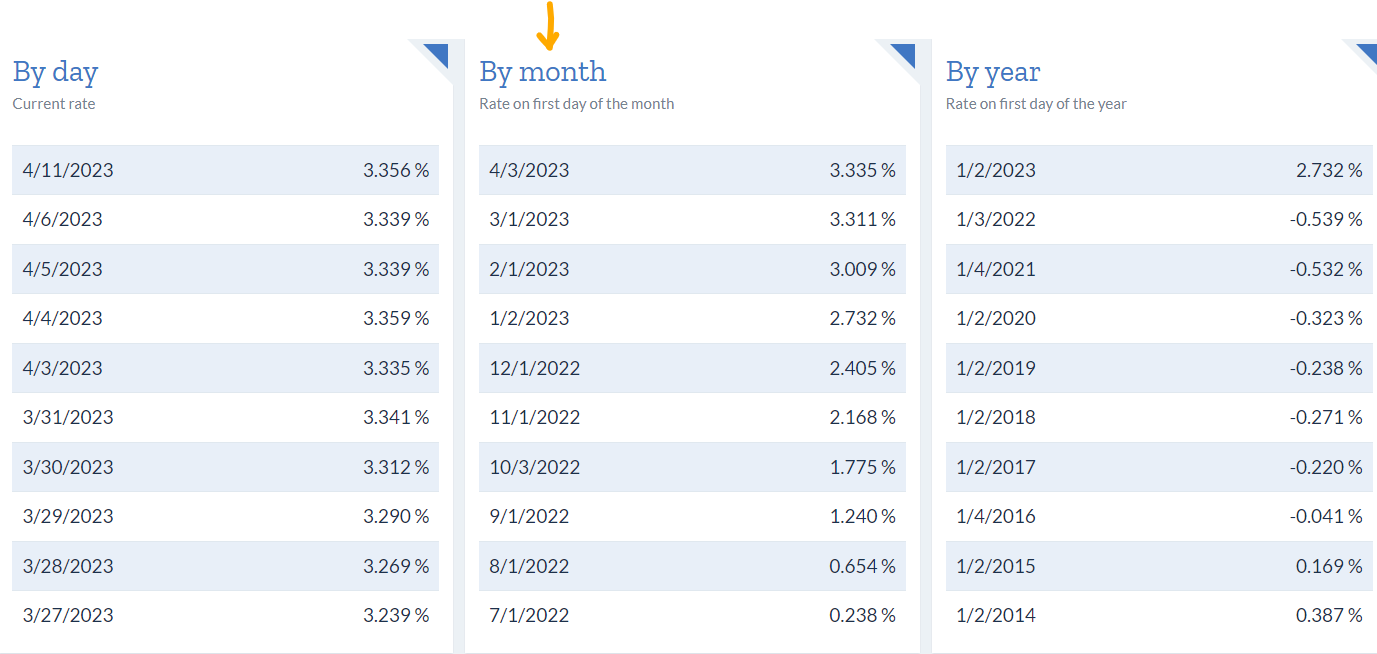

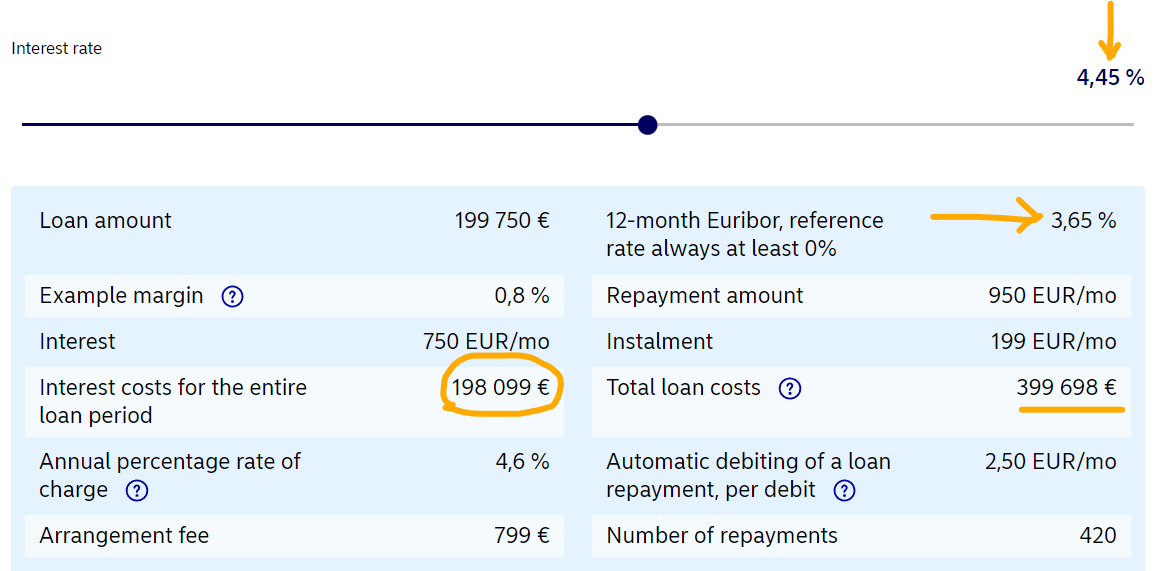

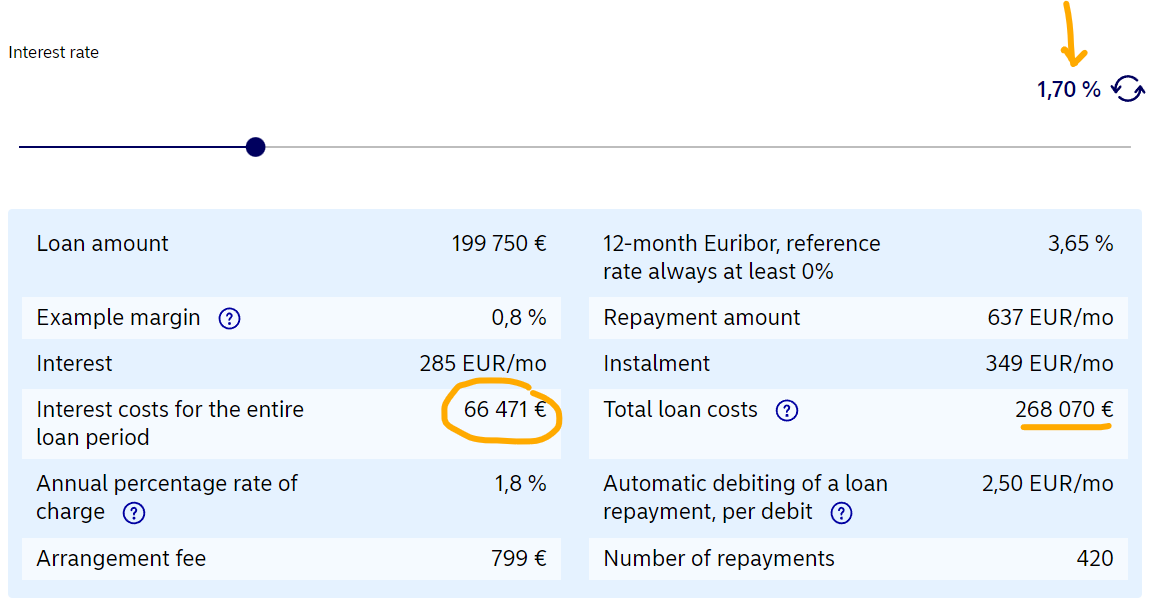

<div class="text-justify"> In 2020, we decided to take the plunge and buy a house. We started looking at the end of January and we settled at the end of February, moving before Easter. It all happened very, very fast. >This was before Covid was "a thing". We had the option for a loan collar up to 10 years. The loans manager said it wasn't common, but I was adamant. When we talked to the neighbors about it, they said it was a waste of money. When I told my colleague, he said it was a waste too. Why pay that bit extra when it could go to other things? They didn't understand my argument that interest rates are the lowest they have ever been and they only have one way to go.  This morning, I was reminded of this, as my colleagues were talking about their loans changing, where their reference rates have shifted significantly. The *reference rate* is the benchmark interest rate and then on top of that, the bank will add its margin. For example in the EU, the Euribor is the blocs reference rate, and with the collar we have on the loan, it references the 6-month Euribor. This is also affected by the loan, but it means that every six months, the loan interest rate will update.  As you can see from the year column, the last seven years, the interest rate has been negative. That didn't cause any problems at all... But, this "negative" is why my friends thought me crazy to be paying a bit extra for the collar, because interest rates were crazy low already, even after the margin. The Loan collar has an upper limit, but it also has a lower limit, which means that if reference interest rates are even lower than that, we would be paying more for the loan. Which we were. >But, we had a good deal. *Or so we thought.* In mid-2021, we found out that the collar hadn't actually been applied to our loan at all, but we hadn't noticed this in the contract. This was a pretty rough time, because the bank no longer had the collar option at all, because they could see where interest rates were going, as could I - >*And I had just suffered a stroke.* But after much fighting, we were able to get the collar put on for ten years starting from the new date, albeit at a higher maximum reference, but they waved the setup fee. And while it was difficult and at times my wife was ready to give up (as she was handling this as I couldn't at all), the stress was worth it and now, *she is very happy I was still adamant.* Because, this is our loan: <center></center> We are paying 1.65% *including margin,* which is the highest it can go for the next 8 years! You can see that the maximum reference is 1.20 (originally it was 0.98, but they screwed up and screwed us), but the current reference is 3.14, which would have been the Euribor around mid-January. What difference does it make? Using ~200,000€ as the base of a 35 year loan, with current margin of 0.8 and full reference rate:  Using ~200,000€ as the base of a 35 year loan, with interest at 1.7%  Now, while not exactly the loan deal we have, there are a couple of interesting things to note here. Firstly of course, is the monthly repayment difference of 327€ a month. That is *enormous* for most people and is about 10% of an average salary, *before tax.* The next thing to note is interest cost difference over the life of the loans, which has the top one costing 132,000€ more over the lifetime. And this hints at a very important factor. Loan 1 at 4.45%, paying 950€ a month  Loan 2 at 1.7% paying 637€ a month  In the first loan, paying 950€ only reduces the principle 199€. In the second though, the reduction is 350€, 75% more. Paying less, paying off faster. And it is this that my wife and I have to start taking more advantage of, by paying it off faster while we have the collar in place. The reason is that with the higher inflation, money is losing value, but we are effectively getting a discount on our loan in comparison to the value. This means that when we put an extra 100€ in a month, it is actually going to have a greater value when spent on our loan, than if we were to use it to buy something, because in our loan, we are locked into "old value" of money. For instance, Buying something for 100€ two years ago, would cost around 120€ today, at the average inflation rate. But, putting that 100€ into the loan, is getting the 100€ value, that can only buy about 80€ of something in the shops now. It means that we could significantly shorten our loan, by using todays money, in the past - if that makes sense. Because our loan isn't subject to inflation from here for the next eight years, everything we put into it while the rates are up, has a supercharged effect on the loan. My friend was saying today that his loan has changed significantly in length, because when he bought the house about five years ago, he would pay 1000€ a month and 900 would reduce the principle, now it has almost reversed, where he is paying the same monthly, but now only 200 goes to reducing the principle. And, a lot of people are choosing to pay "interest only" on their loans at the moment to make ends meet, which means that the interest isn't reducing at all and the loan is getting longer, and longer. I know what you are saying... >Taraz, that was a boring-ass post! Yes. Maybe. Or is it? *Probably.* But, what is interesting about it is what I was discussing with my colleagues this morning. Both of them are smart people who have good jobs and are generally financially savvy, yet - neither of them took a collar because of the tiny price it cost above what they could pay *in the moment.* And when I said that I don't get how people can't predict this kind of future with rising interest rates, they both said, >"but I didn't expect it to go up so fast." But again, the lowest interest rates have ever been and, they have a loan that spans half a lifetime. The chances of it going up in that time are good, especially since they had been declining for so long. The cost of a ten year collar is a fraction of the cost of interest rates moving up even by 1% - but it was still too high of a price. *Loans suck.* So the plan should be to reduce them as fast as possible with disposable income, if there isn't a better investment to spend on. At the moment for my wife and I with the collar, it is again an investment to pay it off faster, because we are getting our loan at that discount. It is like getting a 20% bonus on *everything extra* we put into the loan, which can make a big difference when that collar comes off. As part of the common workplace agreements, both my wife and I will get the base 3% salary increase and I was saying tonight, *I know where it is going to go.* It isn't worth much in the real world, but putting it in the loan today, means it is actually a 3.6% increase and, it also reduces the loan at a faster rate, so it has even a little more value than that. *May as well put it to work.* One of those *small steps* that compounds, in action. Taraz [ Gen1: Hive ] </div> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@tarazkp/supercharger-on-loan)

👍 leovoter, klye, r0nd0n, gaottantacinque, cribbio, invest.country, topbooster.leo, neal.power, gasaeightyfive, sumatranate.leo, venarisyndicate, abh12345.archon, bearjohn, abh12345.pal, mciszczon, therealyme, subhari, kitsuki, orthodoxnudism, rmsadkri, driptorchpress, ew-and-patterns, afterglow, tsurmb, d-company, jontv, jkp.nisha, joeyarnoldvn, babytarazkp, lolz.leo, cryptoandcoffee, khalpal, bruleo, officialhisha, liaminit1, pero82, philnewton, src3, iamfarhad, mvmoning2021, coffeea.token, cst90, khalneox, instytutfi, healthymary, scooter77.pob, rbm, immanuel94, rdfield, tipsybosphorus, dinvest, g4fun, steem.craft, xyz004, abh12345, nichemarket, abitcoinskeptic, misterengagement, dorkpower, mattbrown.art, isabel-vihu, mallorcamum, mrsbozz, blockbroccoli, technicalone, cageon360, thiskava, tamiapt6, abh12345.sports, saboin.sports, allover, superlao, lestrange, pcojines, shanghaipreneur, marcocasario, jamesbrown, cryptoshotsdoom, hive-defender, key-defender.shh, gerardoguacaran, asmr.tist, pataty69, bozz, alexa.art, iikrypticsii, camplife, alexis555, fknmayhem, reymoya95, tatylayla, munhenhos, joaoprobst, rituraz17, photosnap, cocaaladioxine, mytechtrail, meowcurator, bastter, intrepidphotos, carlosp18, dosh, blessed-girl, bigtom13, sbi7, lackofcolor, jongolson, kendewitt, ericburgoyne, shortsegments, cbridges573, bulldog1205, newageinv, njker, cimmeron, pocket-rents, thepeoplesguild, d0zer, roberto58, por500bolos, zemiatin, radard, armentor, mobbs, scholaris, simplifylife, tryskele, alg-nftgaming, abdulmath, kommienezuspadt, mjvdc, teamaustralia, yanes94, lowlightart, potpourry, gringo211985, socialmediaseo, p1k4ppa10, meesterboom, cryptoccshow, heartofdarkness, abcor, abacam, tamaralovelace, marketinggeek, deepresearch.leo, jhelbich, pepitagold, cyclope, agustinaka, justbabybee, leomolina, kurkumita, nanzo-scoop, holoz0r, mummyimperfect, ak2020, emily-cook, t-bot, mafeeva, scoopstakes, nanzo-snaps, kgswallet, espoem, wisbeech, penguinpablo, cryptonized, funnyman, alphacore, hungrybear, dimarmaca, amigoponc, flamethrow, ninahaskin, saltiberra, dechuck, macchiata, joseda94, abrahan414, b00m, stdd, janitzearratia, citizensmith, hive.friends, coinjoe, abh12345.leo, meesterleo, abh12345.stem, slider2990, juecoree.stem, jschindler, aafeng, steemmonsterking, manniman, jasonwaterfalls, sazbird, galenkp, doncustom, galenkp.aus, hive-168869, mrbonkers, marbrym, travoved, sillybilly, intishar, empress-eremmy, frostyamber, meestemboom, gollumkp, luciannagy, bagpuss, shanibeer, boboman, drakernoise, mytunes, combination, becca-mac, lhes, blind-spot, ayummi, celestegray, edkarnie, humbe, cmplxty.leo, depressed.leo, jacobtothe, alucian, preparedwombat, owasco, daveks, artonmysleeve, ileart, edicted, iansart, anonsteve, onealfa, twicejoy, bilpcoinbpc, joseph23, devpress, jokinmenipieleen, urri2020, dune69, isotonic, crimianales, jmis101, tiffin, niallon11, arysi, eforucom.leo, wend1go, nthtv, acidyo, gniksivart, worldwildflora, xves, mister-meeseeks, ghaazi, rendrianarma, leveluplifestyle, trasto, mdasein, nkechi, ninnu, rachelssi, fredrikaa, meltysquid, videoaddiction, agmoore2, fieryfootprints, khaleelkazi, caladan, steem.leo, leo.curator, chloem, leotrail, ztfo, hanez, bananass, leverup, femcy-willcy, jeanlucsr, vempromundo, purefood, organduo, shauner, leo.voter, learn.leo, poam, leofinance, wrapped-leo, infihedge, stackfi, endgames, robmojo.leo, p-leo, bnb-hive, asteroids, jobar, b-leo, p-hive, cubdaily, invest2learn, mcsherriff, bitrocker2020, gadrian, zaxan, dlike, steemaction, megavest, emeka4, onestop, w-t-fi, amongus, elgatoshawua, impurgent, princessbusayo, brume7, steentijd, plicc8, jeffjagoe, arrliinn, cryptictruth, gallerani, ireenchew, coriolis, coinlogic.online, antiretroviral, x9ed1732b, netaterra.leo, v10r8, solymi, creodas, tanzil2024, banzafahra, cugel, kushyzee, xleo.voter, specific-leo, ksam, blacardi, scrubs24, khaltok, thoth442, thauerbyi, break-out-trader, pervitin, vxn666, leo.tokens, elongate, zeclipse, inibless, olujose6, abu78, kevinwong, rufans, roleerob, joannewong, steemxp, raiseup, leo.bank, reonarudo, tiyumtaba, grabapack, henrietta27, micheal87, mhizsmiler.leo, divinekids, flyingbolt, saboin.leo, vintherinvest, eddie-earner, l337m45732, thelogicaldude, travelwritemoney, pouchon.tribes, al-leonardo, jfang003, senorcoconut, beehivetrader, sovstar, rafzat, bimpcy, uwelang, leprechaun, softworld, violator101, neuro101, foggwulf101, santigs, revise.leo, dashroom, not-a-bird, not-a-gamer, beco132, deadswitch, astrocreator, relf87, esportleague, photographercr, thespacebetween, jphamer1, sharkthelion, some-asshole, tht, balikis95, doriantaylor, jk6276, drag33, limka, revisesociology, revise.spk, trafalgar, raindrop, traf, julesquirin, xtrafalgar, kattycrochet, darewealth, generosesity, zekepickleman, steemychicken1, scoutroc, foodchunk, olaunlimited, fw206, rynow, cars-art, pranavinaction, onealfa.vyb, rxhector, nikoleondas, moonappics, chincoculbert, shebe, lisfabian, danielsaori, helgalubevi, papilloncharity, appreciator, freebornsociety, soyunasantacruz, shinyobjects, themonetaryfew, slobberchops, liz.writes, celestal, driedfruit, springlining, juanperaza46, elbuhoaular, politeumico, ducecrypto, awuahbenjamin, drax.leo, feanorgu, bordel, schindmaehre, planetauto, strega.azure,