The Bottom of the One

hive-167922·@tarazkp·

0.000 HBDThe Bottom of the One

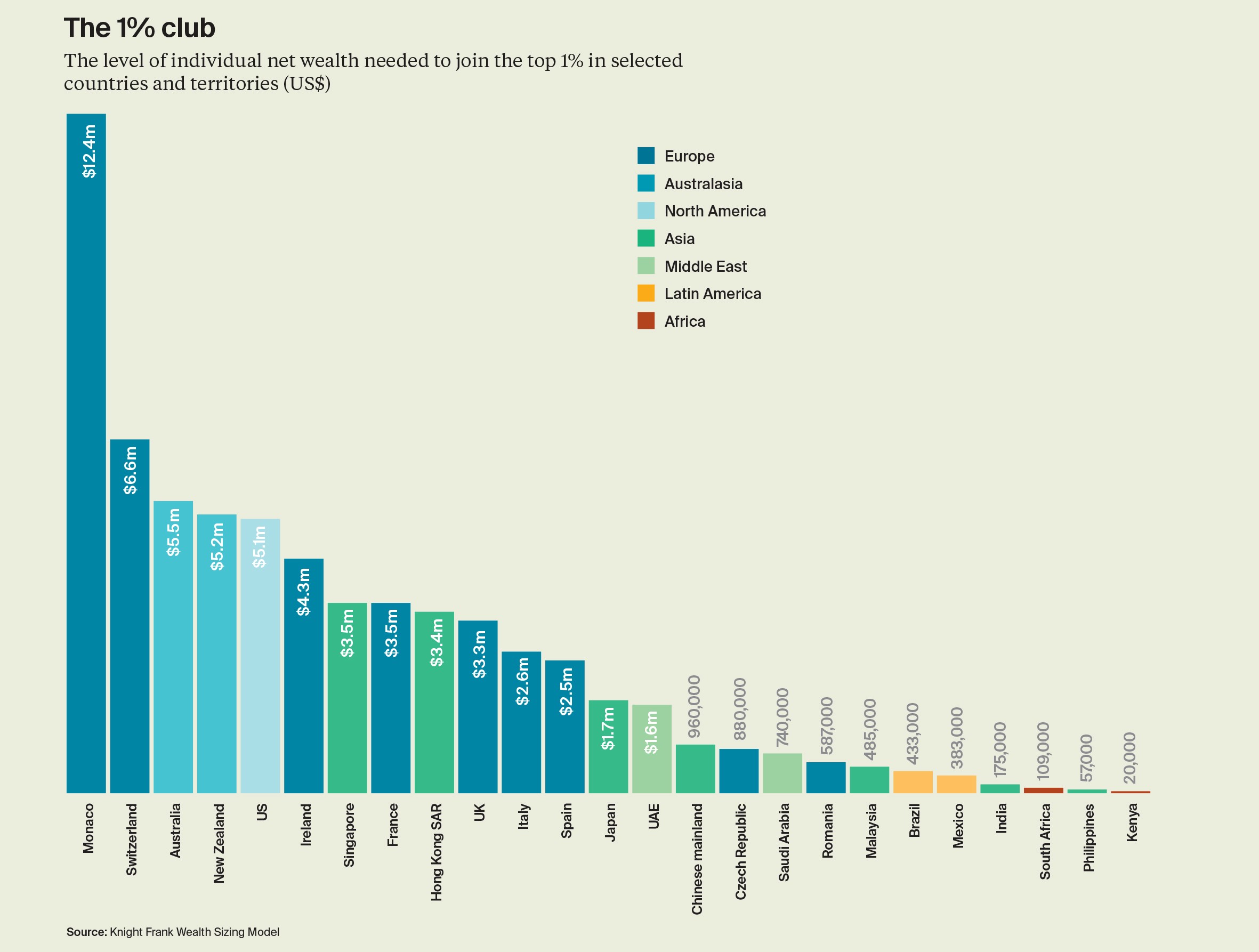

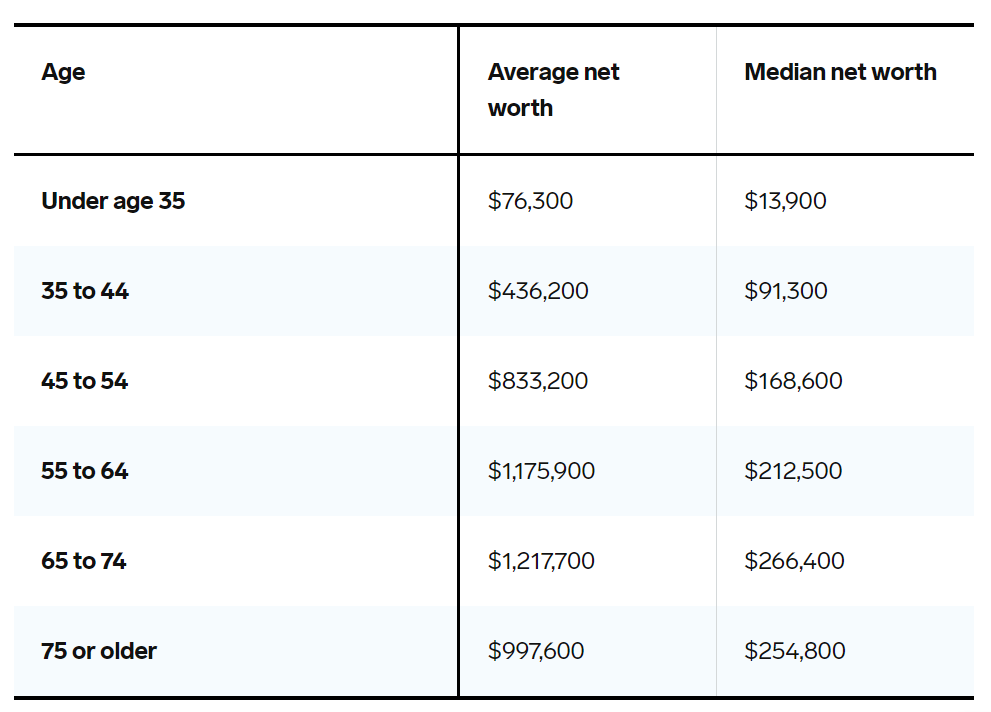

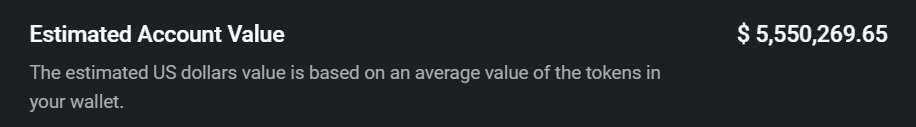

<div class="text-justify">  In the US, you *only* need $5.1M in net wealth to qualify as a one percenter. I say "only" because there is obviously a bit of a difference between scraping into the bottom of the one percent, and being in the 0.1 percent that is a steep curve and the gap is far wider than it is down to the median wealth.  [](https://www.knightfrank.com/research/article/2021-03-01-how-much-wealth-gets-you-into-the-global-top-1) The median is the middle score, and is a better representation of the situation. For instance, if there is a bus of 100 people who are millionaires by average, it could be that 99 of them are worth around 100K and 1 is worth a billion, making the average around 10M each. However, using the median score, it would be close to the 100K. Most wealth distributions are relatively smooth and then hockey-stick at the top end. For instance, note the difference in average and median wealth of individuals in the US by age group:  There is a 4-5x difference between the average and the median, because that how top end skews all the numbers. Remember that the median is the middle score, so there are 50% of people below that point. This means that half of under 35s in the US have a net wealth below $13,900. What caught my eye, was the requirements to be a one percenter at the lower end of the graph around the world. For instance, in Kenya, only $20,000 is needed to break into the top echelon. I say "only" here, because I am sure that like anywhere in the world, being in that 1% isn't easy when looking from a local perspective. That the median US citizen wealth between the age of 35-44, is in the 1% of Kenya by 4x and the average in that age group is in the 1% of Kenya by 24x - It is all very location relative. I have a few Kenyan and Nigerian (similar wealth numbers for 1%) friends and connections on Hive from over the years and I wonder what they think about this, considering that some of them have accomplished one percent status with their Hive value. Or, could have. There are obviously many factors that go into this journey, but it is likely that for those who have been consistent and building their presence and stake, they are likely looking okay in terms of their localized value. For those who for whatever reason took another path, they might be lamenting the missed opportunity so far. One of the challenges we face in a globalized world is being able to acknowledge how we see a view of everything, but don't have visibility and experience at a local level. Even if some comparisons can be made at a financial level, it is impossible to put oneself in another's shoes locally. For example. >For reference in HIVE, an account would need around 57,000 HIVE for 1 percent status in Kenya. 14,570,000 for one percent status in the US. Using France as the Base for Europe, it would require 10,000,000. And, 35,500,000 if in Monaco - which is about 9% of the total supply of HIVE. While the 1% status tells something in terms of local level, comparing one percenters globally doesn't mean the same thing. A Kenyan one percenter lives a very different life to one living in Monaco. Suffice to say, that despite there being HIVE whales, that doesn't automatically put them into one percent status at the local level. Assuming [Freedom](https://peakd.com/@freedom/wallet) is from the US, they just scrape through.  But, while we tend to look to extremes to illustrate, the fact is that the majority of us will never make it to the top 1% of pretty much anything. However, this doesn't mean we can't improve our position in life financially. A little income here and there can start to add up. Some savings on a few things we can go without increases the gap between earning and spending and, a few decent investment decisions and we might be doing pretty at adding to our wealth slowly but surely and in time, we may be glad we did so. The world is changing rapidly and the economy is part of the driving force. There are more opportunities arising, even though some doors are shutting, but we don't really know what is going to be in store for us globally, or at a local level in the future. Having a growth mindset and participating, gives us potential to not only take advantage of the current conditions, but develop to be suitable for the changing situation too. This also increases our chances to see the changes a they are happening, and being early adopters for what is to arrive. The global wealth imbalance is enormous and it affects us heavily locally to lesser and greater degrees, depending on location. However, it isn't suitable to just throw up our hands and hope someone will save us, because we should know by now, that isn't going to happen. If we want to change our position in life, we are going to have to move - no one is going to carry us out of the goodness of their heart. For most of us, Hive is not going to be our financial savior, but it can definitely be a supplementary part of our financial future, especially since it can help us learn and influence our behaviors to improve our processes - no matter where we live in the world. Taraz [ Gen1: Hive ] </div> Posted Using [LeoFinance Alpha](https://leofinance.io/@tarazkp/the-bottom-of-the-one)

👍 gaottantacinque, cribbio, quochuy, smartvote, gasaeightyfive, d-company, kat.eli, khan3579, coinjoe, zyx066, bruleo, pocketjs, joeyarnoldvn, anaclark, mvmoning2021, sumatranate, silversaver888, ma1neevent, islandboi, bilpcoin.pay, healthymary, investingpennies, liaminit1, officialhisha, e-mc2, maybedog, scooter77.pob, thelordsharvest, steemvault, steem4all, communitybank, utube, videosteemit, fantasycrypto, photohunt, photohunter1, photohunter2, photohunter3, photohunter4, photohunter5, superlotto, citizendog, steemstorage, fire451, starfighter, seekingalpha, tokensink, knightsunited, galberto, jigstrike, warmstill, sumatranate.leo, cst90, nin4i, zeero22, abh12345.pal, julesquirin, abh12345.archon, michellpiala, khalneox, tsurmb, bearjohn, idea-make-rich, mrsbozz, babytarazkp, subhari, akipponn, rbm, orthodoxnudism, coffeea.token, shiekhnouman, driptorchpress, noloafing, shohana1.one, retaliatorr, jontv, afterglow, jeffmackinnon, reggaejahm, jkp.nisha, leo-fairy, dbooster, quatro, flipstar.sports, rdfield, shani.jahming, kevinwong, nakary, immanuel94, blewitt, khalpal, dorkpower, tipsybosphorus, steemituplife, mrwang, arconite, nurhayati, steem.craft, therealyme, janetedita, mciszczon, lemony-cricket, cryptoandcoffee, rmsadkri, nichemarket, philnewton, lemcriq, milky-concrete, src3, iamfarhad, not-a-cat, ew-and-patterns, star.lord, tamiapt6, technicalone, edwardstobia, reggaesteem, g4fun, dandesign86, galenkp.aus, we-support-hive, fknmayhem, xyz004, thiskava, smasssh, mapetoke, abh12345, rabona, reymoya95, instytutfi, jayna, revisesociology, thedarkhorse, eonwarped, abitcoinskeptic, dumnebari, misterengagement, mattbrown.art, isabel-vihu, mallorcamum, superlao, shanghaipreneur, triviummethod, edb, ninnu, blockbroccoli, cookaiss, roleerob, mikepm74, pcojines, abh12345.sports, marcocasario, hive-defender, key-defender.shh, saboin.sports, cryptoshotsdoom, goingbonkers, moeenali, lcrestrepo, selfhelp4trolls, molometer, jemmanuel, digital.mine, sperosamuel15, borran, fullcoverbetting, asmr.tist, paulag, redes, erangvee, thrasher666, princessamber, ghostdylan, alexa.art, unmuted, debilog, lerma, iikrypticsii, erang, codingdefined, rubencress, jamesbrown, phortun, camplife, carlosp18, crowdwitness, petrvl, onlavu, bozz, lackofcolor, velinov86, jelly13, papilloncharity, ghazanfar.ali, owasco, bastter, fucanglong, hugo1954, belahejna, lizelle, jongolson, maajaanaa, mjmarquez4151, janaveda, lexansky, sebas04, crookshanks, aussieninja, ericburgoyne, kgakakillerg, goblinknackers, cbridges573, mammasitta, kimzwarch, newageinv, abdulmath, steddyman, photosnap, kendewitt, andywong31, goodcontentbot, votebetting, homeginkit, alg-nftgaming, gavinatorial, sacrosanct, hivebuilder, shortsegments, cryptocurator, zemiatin, voxmortis, jamzmie, freddbrito, islanderman, roberto58, bigtom13, d0zer, minigame, lordnigel, mattclarke, mytechtrail, spiderwhale, korver, uwelang, curatorcat, scholaris, plook, intrepidphotos, rasalom, ibt-survival, nyinyiwin, fourfourfun, gloriaolar, por500bolos, teamaustralia, denmarkguy, blanchy, pal-isaria, journeyofanomad, nicewoody69, mobbs, youraverageguy, jacksonizer, sirjaxxy, chetanpadliya, mjvdc, gringo211985, talentos, simplifylife, ybanezkim26, justasperm, stemisaria, masterzarlyn28, xykorlz, kuwago, teamashen, itinerantph, socialmediaseo, feedmytwi, jude.villarta, iamgem005, leprechaun, tryskele, pishio, not-a-bird, kommienezuspadt, yanes94, meno, lowlightart, potpourry, meesterboom, davidtron, cryptoccshow, evilest-fiend, roronoa46, nickydee, jaynie, milu-the-dog, marketinggeek, abcor, abacam, angelica7, bet1x2, celestal, wolfhart, contentisking, allyson19, saboin, aulia1993, goodcontentbot1, diverse, cyclope, skiptvads, steempampanga, agustinaka, cjsean, noechie1827, khiabels, london65, hubyr, hedidylan, cabalen, jadung, rappler, angelanichole, theithei, pastoragus, glstech, devpress, neove, leomolina, jhelbich, pepitagold, consciousness, whistleblower, crimsonclad, anarcist69, clayboyn, bigdizzle91, blarchive, veganism, popsfishing, steemitcommunity, yestermorrow, authors.leage, bobthebuilder2, eugenekul, siggiboy81, hyborian-strain, preparedwombat, kurkumita, heartbeat1515, wisbeech, shanibeer, rtytf, halukshananah, nanzo-scoop, sorin.cristescu, i-c-e, mummyimperfect, ak2020, emily-cook, t-bot, mafeeva, scoopstakes, nanzo-snaps, kgswallet, espoem, fanstaf, dimarmaca, fieryfootprints, penguinpablo, cryptonized, funnyman, alphacore, macchiata, hungrybear, jacuzzi, dinglehopper, joseda94, deisip67, soyrosa, nateaguila, b00m, plint, abrahan414, citizensmith, alexdory, amigoponc, hivewatchers, steemcleaners, eturnerx, fatman, msp-makeaminnow, voter003, voter000, nurul-uli, abh12345.stem, slider2990, juecoree.stem, hive.friends, pladozero, abh12345.leo, meesterleo, zekepickleman, aafeng, edkarnie, jasonwaterfalls, uruiamme, sazbird, edicted, vempromundo, anonsteve, iansart, acidyo, steeminator3000, gniksivart, tobias-g, worldwildflora, xves, mister-meeseeks, ghaazi, leveluplifestyle, trasto, mdasein, rendrianarma, tillmea, didutza, p1k4ppa10, santigs, elyelma, galenkp, softworld, freedomring, hive-168869, gollumkp, sillybilly, meltysquid, fw206, meestemboom, vasko90, emma-h, ssebasv, munteha, erilej, luciannagy, bagpuss, joeabraham, meowcurator, cryptosimplify, contapoupanca, daveks, artonmysleeve, simplymike, noekie, naturalkiller, becca-mac, organicgardener, battlemaster, monsterdoom, bfciv, limaescritora, themonetaryfew, nthtv, canadian-coconut, ecotrain, elamental, steelborne, emotionalsea, jerrybanfield, blind-spot, lordbutterfly, belemo, zwhammer, joshman, hivefolks, pappyelblanco, bia.birch, ivangeevo, russia-btc, litalfrog, arc7icwolf, almi, sbi5, janitzearratia, celestegray, bitcoinflood, revise.leo, dashroom, not-a-gamer, yorguis, trumpikas, rynow, tamaralovelace, fredrikaa, intishar, deadswitch, ileart, ga38jem, slobberchops, liz.writes, frostyamber, cowboyzlegend27, jokinmenipieleen, photographercr, videoaddiction, insaneworks, behiver, sydechan, jk6276, jfang003, mellys, juanperaza46, awuahbenjamin, trafalgar, raindrop, traf, kattycrochet, el-dee-are-es, cmplxty.leo, rolaz123, liseth.zamora, tracer-paulo, olaunlimited, wiseagent, hiveclick, nachomolina2, wend1go, dagger212, stokjockey, springlining, boboman, stdd, carolinawnn, davidjesuscd, jesusdcd, chanmaly, nrg, ubg, johnbenn, yann03, planetauto, ericvancewalton, pocketrocket, txerritxoa, raphaelle, arcange, shainemata, laruche, rohansuares, aweee, walterjay, aidefr, robotics101, pboulet, louis00334, steemitboard, marivic10, ancolie, drag33, michaelklinejr, zaibkang, relf87, agmoore2, ssekulji, thegoliath, gungunkrishu.leo, nuagnorab, ronbong, everrich, catanknight, moneyheist-sl, krischy, nicolemoker, ryivhnn, gorc, pixietrix, shadowlioncub, nyxlabs, drax.leo, manoldonchev, schindmaehre,