The next (real) ATH?

hive-167922·@tarazkp·

0.000 HBDThe next (real) ATH?

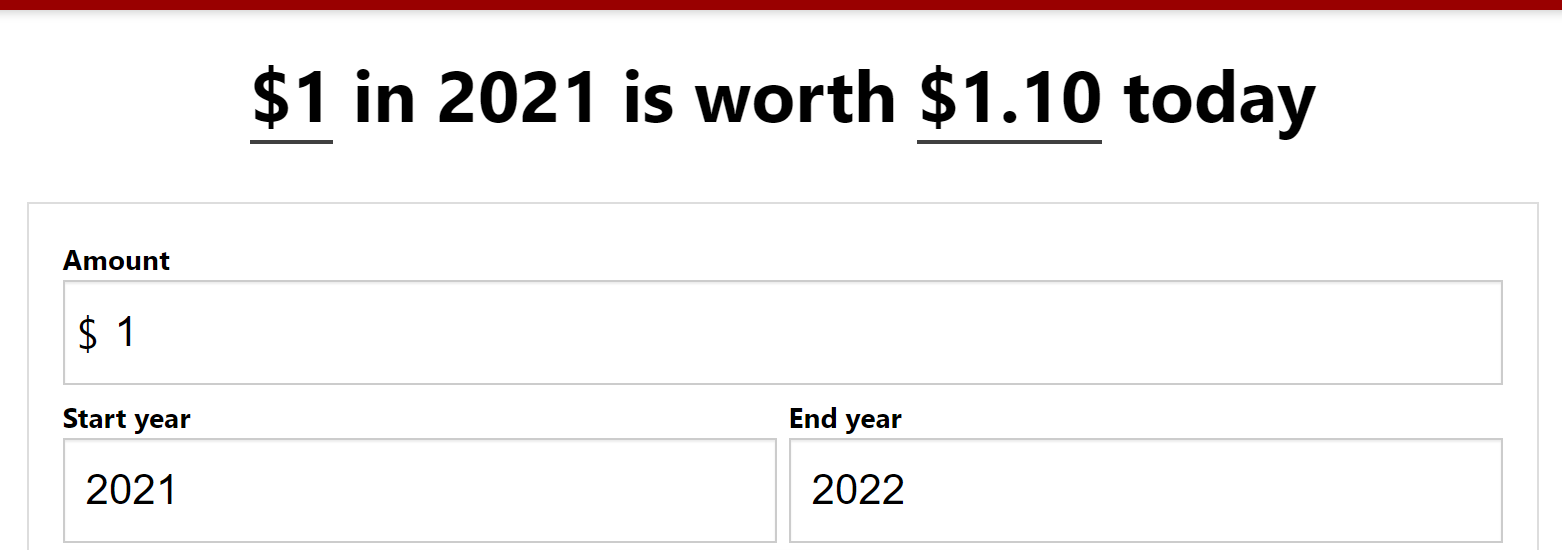

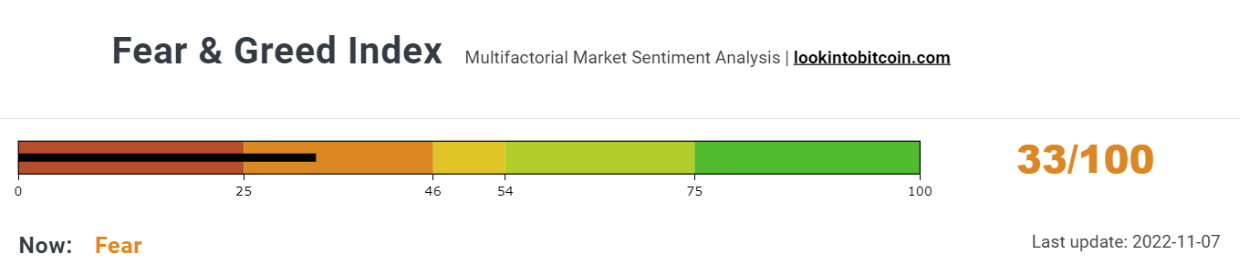

<div class="text-justify">  On the 11th of November, we will be one year from the last All Time High (ATH) of Bitcoin at 67.5K, which seems like *an eternity* ago, considering that since then, there has been a low of 18.5K - A fall of over 70% in 12 months. However, it is actually a bit worse than that, because also in that time, inflation has risen with an average of over 8%, meaning that the real value of current price is worse than it appears.  Factoring in purchasing power, Bitcoin at the current 19,700 is buying the same as 18,100 a year ago. And, this also means that in real terms, if Bitcoin was to ATH today, it would need to hit 72,900 for 1 BTC to be able to buy as much as 1 BTC a year ago.  This is quite interesting to consider in many respects, where for example, the pay increase I got at the start of the year when I took a new position with far more responsibility and workload, while still positive in terms of earnings, is *far less* than what it was worth when I agreed to it. However, at least I got the increase that holds me around +/-0, as staying in the position I was would have saved me effort with lower responsibility, but still would have been impacted by inflation in real purchase respects. On a post I wrote last night, there was a comment about the future of crypto prices requiring trust on crypto in the market place, but I disagree with this. Not because trust isn't important, because it *definitely is* for projects aiming for longevity, but because it isn't needed for most projects, as they just want hype. And hype is a driver of what they need - ## Greed. *Greed is good.* At least for investment values in the markets, because when people are greedy, they want to buy, they want to get them gains. And, because there has been a *massive amount* of over printing of the money supply through quantitative easing policies in the last few years, there is going to be a lot of volatility, as that "new money" moves into more speculative and higher risk/reward investment assets, especially as interest rates will begin to fall, making investing more attractive again.  It seems that unlike a few weeks ago, we are out of the "extreme fear" stage and people are looking ahead and trying to predict the future. Whether this was the bottom or not is yet to be seen however, and the next few months should give an indication of where we are heading. Whatever way we look at it though, due to all of this extra money in the supply, we have to be wary of our relative purchasing power, because that is what actually affects our daily lives. Once upon a time, being a "millionaire" meant something, but for example in Australia, over 11% of the adult population are considered millionaires, because it factors in all assets. But, is owning a house that has appreciated heavily in value over the last years really indicative of true wealth? Unlikely, as that isn't liquid, it isn't usable and, if those assets were suddenly to be sold, the percentage of millionaires would rapidly decrease, as the assets that make up that wealth erode quickly in price. When I was a kid, the dream was to have a million dollars in the bank and live off the interest, which at the time, would have generated over twice the average income and about 1.5x the average after tax. Plenty to live off. However, it would now produce only a third of the average income and around 25% after tax - making a million in the bank, "not what it used to be". If inflation keeps increasing, those with significant holdings are going to have to make some pretty strong decisions on what they do with their wealth, otherwise, it is going to keep eroding. And, while the crypto markets are volatile, they are also relatively small in the grand scheme of things, meaning that people might become more risk-seeking and throw a percentage dice down the track at the future. With more people realizing that 1 BTC is 1 BTC at 5K, 20K or 60K, they might start choosing to gamble on that future price and load up, willing to take the losses in the short term, until scarcity and high demand drive up the prices in the mid to long, in the hope to beat inflation and the devaluation of their wealth through economic mismanagement from the governments, which is completely out of their hands. At least with BTC, they don't have to worry about governments just printing more of it when it suits them. >Crypto is a hedge. Yes, it is unlikely that many new investors are going to go all in on crypto, but this "organic" growth is likely far more valuable for the industry, as it creates a more stable base and the longer people are in, the more likely they will *stay in.* Those who are for short gains, will only ever be around when there are quick gains to be made, but those who are looking longer and holding longer, will value more accumulation, even if it is only a percentage of their holdings. When there are hundreds of millions of people accumulating small amounts, it adds up fast and, it generates more scarcity, as well as more potential for uplift through less people willing to part with their holdings cheaply, as they start to have more "sentiment" about what they hold. >Just look at the long-term HIVE holders. Trust is important, but in investing and especially in speculative investing, it isn't required, other than the trust that tomorrow it will still stick around. It has been almost 14 years since the creation of Bitcoin and it has seen, is seeing and will see, a lot more FUD aimed at slowing down adoption. Yet still, crypto uptake continues, as does the development of the goods and services that turn a speculative asset into a an industry of business and commerce. And when it turns into an industry, those businesses need to build trust with their investors, customers and consumers, that they offer something of value and, will be around in the future. Market price however, isn't a good indicator of usecase, all it tells is the sentiment of the speculators in the moment. It doesn't indicate success of product, nor does it tell anything about longevity - but regardless of how useless it is as a predictor, it does get the majority of the attention and focus, especially from the media. When that next ATH comes, holders will celebrate, advocates will feel justified and nocoiners will lament - but, what will the real value of it be, what will 68K be worth in the real world of purchase power? Much like my salary that looks good on paper in comparison to the past, the reality is quite different. But everyone loves an ATH. I don't know when the next ATH will be, but the next "real" ATH in terms of purchasing power, is going to be some time after that. Taraz [ Gen1: Hive ] </div> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@tarazkp/the-next-real-ath)

👍 leovoter, gaottantacinque, r0nd0n, juecoree, dwayne16, cribbio, invest.country, therealyme, rdfield, meta.condeas, dinvest, topbooster.leo, neal.power, noloafing, ikrahch, nakary, gasaeightyfive, abh12345.archon, jkp.nisha, netaterra, immanuel94, khalneox, warmstill, venarisyndicate, we-are-one, teamvn, smartvote, sumatranate, cst90, we-are, liaminit1, khalpal, jeffmackinnon, mvmoning2021, steem.craft, abwasserrohr, bearjohn, kat.eli, jontv, drexlord, coffeea.token, babytarazkp, dbooster, rbm, scooter77.pob, akipponn, driptorchpress, rmsadkri, officialhisha, joeyarnoldvn, tsurmb, retaliatorr, hive-142864, kevinwong, silversaver888, afterglow, sumatranate.leo, d-company, abh12345.pal, bruleo, mrwang, arconite, nurhayati, mciszczon, andyblack, reggaejahm, shani.jahming, dorkpower, dandesign86, cryptoandcoffee, tipsybosphorus, dagger212, philnewton, src3, iamfarhad, nichemarket, tamiapt6, we-support-hive, steemflow, ew-and-patterns, g4fun, edwardstobia, lestrange, xyz004, hive.friends, mrsbozz, instytutfi, reggaesteem, abh12345, allover, joele, jayna, abitcoinskeptic, tobias-g, racibo, misterengagement, abh12345.ccoin, mattbrown.art, isabel-vihu, mallorcamum, smasssh, revisesociology, blockbroccoli, edb, ninnu, cookaiss, revise.spk, borran, goingbonkers, pcojines, drricksanchez, hugo1954, yousafharoonkhan, thrasher666, papilloncharity, jamesbrown, mikepm74, jemmanuel, rituraz17, alexa.art, fknmayhem, asmr.tist, abh12345.sports, shanghaipreneur, codingdefined, marcocasario, reymoya95, andrastia, saboin.sports, mamalikh13, superlao, iikrypticsii, carlosp18, kgakakillerg, blewitt, digital.mine, jongolson, bastter, kgsupport, erangvee, ericburgoyne, angelica7, cbridges573, dosh, camplife, lerma, rubencress, goblinknackers, voxmortis, votebetting, photosnap, crowdwitness, molometer, fullcoverbetting, moeenali, gerardoguacaran, islanderman, selfhelp4trolls, bozz, lackofcolor, d0zer, minigame, korver, zemiatin, roberto58, denmarkguy, lizelle, darthgexe, rasalom, itinerantph, mytechtrail, blainjones, scholaris, mjmarquez4151, mjvdc, teamaustralia, ultima-alianza, joydukeson, por500bolos, gringo211985, maiu, chetanpadliya, abdulmath, shortsegments, socialmediaseo, blanchy, janaveda, bigtom13, janitzearratia, tryskele, trucklife-family, fenngen, uwelang, kommienezuspadt, binkyprod, allyson19, hubyr, angelanichole, theithei, glstech, yanes94, fourfourfun, lowlightart, potpourry, psicologiaexpres, cryptoccshow, louis88, nickydee, leprechaun, ministerwallay, meesterboom, steemitbloggers, roleerob, abcor, teamashen, abacam, cards4rent, bet1x2, clarissaaaa, contentisking, priyanarc, marketinggeek, aljif7, cjsean, cyclope, agustinaka, shohana1, jhelbich, eturnerx, pepitagold, tokenizedsociety, bobthebuilder2, kurkumita, halukshananah, justbabybee, hive-186141, shanibeer, tomiscurious, nanzo-scoop, arasiko, mummyimperfect, ak2020, emily-cook, t-bot, mafeeva, scoopstakes, nanzo-snaps, goodcontentbot, kggymlife, kgswallet, espoem, ctrpch, wisbeech, dinglehopper, cabalen, relf87, macchiata, dandays, azircon, inpursuit, rappler, pursuant, joseda94, ksteem, abrahan414, b00m, drag33, citizensmith, alexcocopro, bluemoon, jloberiza, steemcleaners, fatman, votehero, msp-makeaminnow, thefoundation, hivewatchers, freddbrito, abh12345.stem, slider2990, abh12345.leo, cd-stem, juecoree.stem, meesterleo, thatkidsblack, kawsar8035, dstampede, my451r, fieryfootprints, ratnaayub, penguinpablo, cryptonized, funnyman, alphacore, hungrybear, jacuzzi, e-mc2, jasonwaterfalls, sazbird, riz611, aafeng, sillybilly, greddyforce, guitarmcy, aswita, cryptohaytham, pinkchic, becca-mac, preparedwombat, davidesimoncini, taskmaster4450, unyimeetuk, mightpossibly, rohansuares, susie-saver, rpren, fredhill, galenkp, bilpcoin.pay, beautifulwreck, galenkp.aus, bagpuss, hive-168869, l337m45732, the.rocket.panda, emma-h, khaleelkazi, leo.curator, chloem, leofinance, bnb-hive, jeanlucsr, vempromundo, organduo, steem.leo, robmojo.leo, p-leo, p-hive, cubdaily, wrapped-leo, purefood, cakemonster, shauner, leo.voter, asteroids, leotrail, b-leo, femcy-willcy, kam5iz, videoaddiction, zaxan, elgatoshawua, brume7, minloulou, onestop, bella76, cugel, gwajnberg, zuly63, solominer.leo, xleo.voter, dante31, joannewong, break-out-trader, ireenchew, apokruphos, thefalcons, megavest, coinlogic.online, x9ed1732b, syberia, reonarudo, leo.tokens, amongus, steentijd, banzafahra, njker, trasto, saboin.leo, jkeen33, grabapack, specific-leo, mindtrap, getron, dlike, anonsteve, empoderat, netaterra.leo, rondonshneezy, blacardi, kushyzee, zeclipse, khaltok, plicc8, rufans, bitrocker2020, thauerbyi, thetimetravelerz, gadrian, gallerani, raiseup, steemaction, w-t-fi, elongate, luckyali.leo, impurgent, gniksivart, runicar, edian, emeka4, steemxp, flyingbolt, pardeepkumar, ocupation, enjoyinglife, sacrosanct, elektr1ker, diverse, leoball, trumpikasleo, simplymike, organicgardener, oac, noekie, battlemaster, naturalkiller, monsterdoom, mylibrary, royaleagle, flxlove, ltcih, ltcij, ltcil, ityp, logantron, gawz69, doomsdaychassis, itmp, vintherinvest, thanksforplaying, golddeck, gooddeck, torrey.leo, ezraswish, eddie-earner, travelwritemoney, india-leo, text2speech, photolovers1, agro-dron, luueetang, pouchon.tribes, bala-leo, hivehustlers, jglake, maddogmike, hankanon, urri2020, dune69, isotonic, crimianales, chinito, ragnarhewins90, uruiamme, hivehealth, luciannagy, meowcurator, cassillas5553, jmsansan.leo, hivelist, ganjafarmer, blind-spot, kaerpediem, dknkyz.leo, dknkyz, techjack67, senorcoconut, beehivetrader, fredrikaa, asklanbudi, rynow, davidlionfish, fronttowardenemy, taskmaster4450le, adambarratt, rodent, oakshieldholding, leoline, hykss.leo, alokkumar121.leo, jocieprosza.leo, foreverhero, sabajfa, globalcurrencies, lbi-token, khan.dayyanz, godfather.ftw, onealfa, mindtrap-leo, star.leo, pouchon, alz190, chanmaly, intothewild, broncnutz, astrocat-3663, ileart, katerinaramm, aboutheraklion, jphamer1, sharkthelion, astrolabio, amryksr, edkarnie, edicted, iansart, im-ridd, disagio.gang, clifth, zarnoex, fw206, canadian-coconut, travoved, celestal, driedfruit, nthtv, pvinny69, devpress, jokinmenipieleen, ribalinux, celestegray, ericvancewalton, limka, agmoore2, insaneworks, ssekulji, ducecrypto, tamaralovelace, empress-eremmy, daveks, artonmysleeve, paasz, forexbrokr, crypto-guides, lalupita, leoalpha, jk6276, revise.leo, blockbeard, dashroom, not-a-bird, not-a-gamer, alucian, manniman, deadswitch, danielsaori, robertmendontza, trafalgar, raindrop, traf, julesquirin, xtrafalgar, kattycrochet, new-spirit, el-dee-are-es, sodomlv, nikornkulatnam, bitcoinflood, olaunlimited, vxc.leo, desiredlady, yibbiy, tht, photographercr, sbi4, cinqowy, jacobtothe, jfang003, strawberrry, santigs, softworld, iykewatch12, piya3, ryivhnn, gorc, pixietrix, shadowlioncub, nyxlabs, cmplxty.leo, motionup, depressedfuckup, mayor333, anacristinasilva, yakop, videosteemit, onealfa.leo, webdeals, scooter77, shebe, everrich, catanknight, moneyheist-sl, nuagnorab, ronbong, krischy, nicolemoker, onealfa.vyb, ablaze, pablodare2, planetauto, humbe, schindmaehre,