How Early Are We In The Crypto Game?

hive-167922·@taskmaster4450·

0.000 HBDHow Early Are We In The Crypto Game?

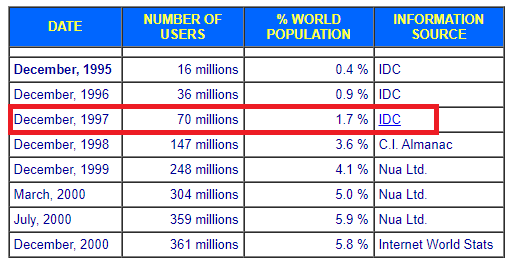

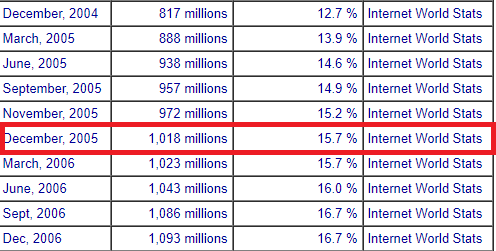

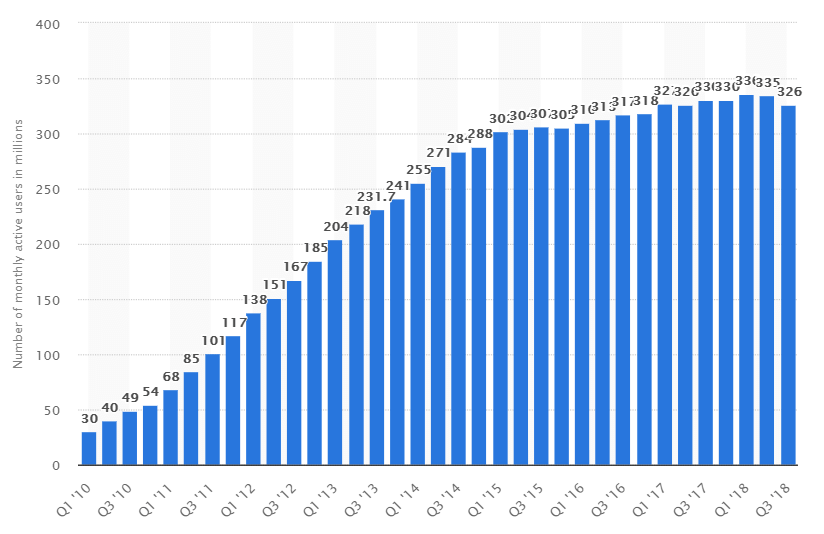

Many are worried that it is too late to get into Bitcoin and other cryptocurrencies. At the same time, some ponder if the governments will simply shut the entire thing down. To get the answer it is best to frame where we are in the process. Willy Woo is a well known Bitcoin trader and advocate. Recently, he drew the parallel between Bitcoin and the Internet. His claim is that Bitcoin is roughly to the point of the Internet circa 1997. He also states that the growth rate is much quicker, meaning that we could see about 8 years of Internet advancement in the next 4. >In terms of adoption, Bitcoin has roughly the same users as the Internet had in 1997. But Bitcoin's growing faster. Next 4 years on current path will bring Bitcoin users to 1b people, that's the equivalent of 2005 for the Internet. <center>[Source](https://u.today/bitcoin-has-roughly-same-amount-of-users-as-internet-had-in-1997-crypto-expert)</center> This is a fair assessment. The parallels between the Internet and cryptocurrency make a ton of sense. It is also one of the reasons why people can take solace in understanding that we are still very early in this process. So what do the numbers look like? According to Internetworldstates, IDC had the user base of the Internet pegged in 1997 as such: <center></center> The revealing part of this is the fact that it was only about 1.7% of the entire global population. Woo's estimate on the growth rate would also be impressive. <center> [Source](https://www.internetworldstats.com/emarketing.htm)</center> By the end of 2005, the Internet users totally more than 1 billion people. Woo is suggesting that Bitcoin will go from roughly 70 million users to more than 1 billion in the next 4 years. We must keep in mind that Woo is what is termed a "Bitcoin Maximalist". He believes that is the only cryptocurrency that will be used. Personally, this does not make a lot of sense to me but it is not uncommon for people with financial backgrounds to believe we will replicate the present system, but based upon Bitcoin. Nevertheless, the thought process in terms of growth rate is most likely sound. The numbers could be a bit bigger if we use all of crypto as opposed to just Bitcoin. Certainly Ethereum having so many wallets will be adding a few more to the totals. That said, it is likely that most who are involved in Bitcoin, or crypto in general, have at least some Bitcoin in a wallet. It is the first crypto-asset that many invest in when they find this arena. <center>https://www.bitprime.co.nz/wp-content/uploads/slider5/1.png [Source](https://www.bitprime.co.nz/wp-content/uploads/slider5/1.png)</center> The challenge with this is the fact that cryptocurrency still has not found the "Killer DApp". While many consider Bitcoin, itself, to be that, it does not seem likely. Obviously, that set things in motion with the introduction of the white paper by Satoshi. However, the masses are not flocking to Bitcoin. In fact, with the recent reports of Whale wallets exceeding the 10-1,000 BTC holders, one could make the case that Bitcoin is the exact opposite. Thus, we are still looking for the application that pulls large numbers of people to cryptocurrency. Over the past couple weeks, I made the case that Leofinance's new microblogging application will have the potential to grab a large share of users. Since it has an almost non-existent learning curve to get started, it could be the ideal application to introduce people to "Web 3.0". Twitter's growth rate shows us how powerful the process can be. <center> [Source](https://www.researchgate.net/profile/Mohamed_Baeth/publication/335972092/figure/fig2/AS:805914873434113@1569156487468/Number-of-Twitter-users-over-time-statistacom.ppm)</center> This chart shows how it went from 30 million users in 2010 to 240 million in only 4 years. The difference is that when Twitter was starting out, people did not know what Twitter was. Today, that is not the case. There are over 330 million users of that platform, many whom are starting to question whether centralized social media is beneficial or not. The actions by the Big Tech companies is starting to spread some fear among users around the world. <center>https://dcustom.com/wp-content/uploads/2018/11/iStock-157590945.jpg [Source](https://dcustom.com/wp-content/uploads/2018/11/iStock-157590945.jpg)</center> One of the evolutions that is taking place, largely unnoticed, is the merging of social media and finance. Obviously, the WallStreetBets episode shows how powerful social media is in bringing people together. It can put the power of decentralization to work by uniting people around a common cause. In this instance, Wall Street hedge funds were the target. However, this is a move that is much bigger than that. We are seeing the ability to conduct financial activities starting to be built into social media platforms. The most obvious is Web 3.0 applications since they are tied to cryptocurrency. These digital assets provide the foundation for what can become an entirely new financial system. Just like the smart phone brought together mobile, computing, and the Internet, the merging of finance and social media can be equally as powerful. The world of social media is gaining in importance. As more people join the Internet, the numbers will keep growing. Cryptocurrency allows for social networks to operate as economies. In short, they become their own markets. While present social media has economic activity, it is a byproduct of the platform. Web 3.0 is constructed in such a manner that it is native. <center>https://miro.medium.com/max/800/1*JzEpa6aK92q5KTyJGYDn_g.png [Source](https://miro.medium.com/max/800/1*JzEpa6aK92q5KTyJGYDn_g.png)</center> Thus, we need to realize that this is still very early days in the process. The above chart is the typical technology life cycle. We are still pre "The Chasm". Crossing that is when we start to move away from the early adopters and head towards the majority. We are, however, far enough along, that it is going to be tough for anyone to stop this shift. Ultimately, the pace of government is going to hinder the attempts. Even if they get their act together in 1 year, a feat highly unlikely, that means, according to Woo's calculations, there will be more than 200 million users. In short, the longer it takes them to on top of things, the bigger this mountain becomes. The pace of adoption is not without precedence. In the U.S., smartphone adoption went from 0 to more than 70% in under 8 years. Cryptocurrency is obviously starting at a point higher than 0, thus we have a better baseline to draw from. We will see massive growth over the next few years. At that point, by about mid-decade, then we will see the push to mass adoption. One billion crypto users by 2025 is logical. Best guess, that is likely a 10x from here. ___ If you found this article informative, please give an upvote and rehive. https://images.hive.blog/0x0/https://files.peakd.com/file/peakd-hive/doze/MkkDNhyH-2020_04_13_16_57_48.gif gif by @doze  logo by @st8z Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@taskmaster4450/how-early-are-we-in-the-crypto-game)

👍 stmdev, limka, coredump, leovoter, tonimontana.leo, tonimontana.neo, toni.pal, rollingbones, pjansen.bcp, r0nd0n, optimizer, nathen007.leo, scaredycatguide, jk6276, anonsteve, dalz4, jff7777, khalstem, moeenali, scaredycatcurate, babytarazkp, brutoken, spinvest-leo, nikoleondas.leo, leoschein, gualteramarelo, moeen.leo, wolffeys, zkalemiss.leo, richasingh, tronsformer, mind.force, bruleo, sharkleo, shadowspub, hetty-rowan, jaquevital, brofund-pal, resiliencia.leo, bruarch, yangyanje, ronpurteetv, writeandearn, d-company, abh12345.neox, khalpal, neoxcur, farizal, trumpman2, apoloo2, shepherd-stories, spinvest-neo, olivier.jacobs, leoaction, leoup, papadimos, oakshieldholding, oelgniksivart, snoochieboochies, shawkr13, movingman, borbolet, glastar, buggedout, reggaejahm, afril, mrsbozz, rehan.neox, sepracore, dera123, shanibeer, jadnven, hivecur2, pjansen.leo, sumatranate, sumatranate.leo, kaniz, ctime, dcooperation, alexabsolute, scottshots, jacksonchakma, libuska, zainenn, tipsybosphorus, behelen, cowboysblog, nelsonnils, issymarie2, jasonbu, sumatranate.neo, blind-spot, sbi3, josediccus, musinka, sbi-tokens, patientgamer9, thekillingqueen, reggaesteem, steem-holder, onetin84, tomiscurious, gabbynhice, usainvote, leoline, netaterra, pixelfan, pixresteemer, revisesociology, eflash, dine77, blockbeard, therealyme, dexy50, anacristinasilva, inature, craignow, garlet, ninnu, nautilus-up, fatman, voter003, voter000, gonklavez9, lordbutterfly, solcycler, voter001, agent14, vxc.leo, downvoteme, aquarius.academy, markkujantunen, diabonua, leo.voter, borran, madstacks, itchyfeetdonica, jemmanuel, partitura.leo, rituraz17, cpi, uwelang, ahmadmanga, mcoinz79, roleerob, howiemac, warpedpoetic, paragism, gadrian, alokkumar121, tulwave, engrsayful, belico, tiffin, bala-leo, bastionpm, leofinance, actioncats, pixiedust4u, adamada.leo, kimzwarch, thrasher666, dickturpin, smasssh, bahagia-arbi, crazydaisy, rehan.blog, konda, shadflyfilms, culgin, indiaunited, solairitas, abh12345.leo, borgheseglass, feedmytwi, city-of-dresden, ro-witness, raiseup, victor-alexander, penpals, votebetting, hardikv, simonpeter35, jatinhota, lifecruiser, inuke, bobinson, sankysanket18, aneilpatel, vishire, v007007007, shonyishere, frames, bala41288, vinamra, ayushthedreamer, shahaan, raqibul, rainbowbala, indiaunited-bot, lion200, yashoda, captain.future, worldhelper, solairibot, culgin.xpost, hive-101493, tasri, shanghaipreneur, notconvinced, tonyz, krakonos, costanza, flores39, voxmortis, steemitcuration, steem-key, rus-lifestyle, diggndeeper.com, daisyphotography, bozz, teutonium, src3, bastter, camplife, chorock, sportfrei, rufruf, he-index, bigram13, rawutah, rasalom, miniteut, rehan-pal, bil.prag, ioioioioi, claudio83.leo, fractalnode, freebornsociety, arac, yameen, photosnap, mborg, voxmonkey, letshodl, dknkyz, thranax, bwar-ag, chireerocks.neox, chireerocks.leo, empoderat.leo, chireerocks.pal, alphahippie, vtol79, meta.condeas, resiliencia.pal, shurbertum, leoneil.leo, gunthertopp, eturnerx, likwid, abdul.qadir, fourfourfun, promobot, friendsofgondor, abcor, gimp, davidlionfish, mehmetfix, twoitguys, maruskina, roberto58, rezoanulv.leo, netaterra.leo, completewind, amariespeaks, howtostartablog, jondoe, mehta, abacam, xcore, leeyh2, raspibot, scholaris, por500bolos, lebin, steem-tube, altonos, akainu, jrcornel, adambarratt, chetanpadliya, znnuksfe, bet1x2, veganomics, daleron, fireon, misterios, corill, xmedia, bkt, jamys, hill007, ilboss, briatore, byoo, norba, qaap, pompeo, sfrd, brazid, korta, hortex, fres, vakum, stubborn-soul, peacefighter, firstwave, forwardassault, fitzmagic, monstergateway, speedwinning, savageduels, splinterembassy, playitout, pinksplinter, dineroconopcion, mytechtrail, cst90, btscn, zemiatin1, platino94, daveks, sift666, planosdeunacasa, osmi, zonabitcoin, djkrad, alexanderlara, aballarde53, robertoueti, mtl1979, hendersonp, ubikalo, fjcalduch, fsegredo1, henlicps, robertojavier, kermosura, poliwalt10, joker777, camila19, elgranpoeta, helengutier2, localgrower, baiboua, french-tech, yuza, puza, crypto.story, mintrawa, nalexadre, steempeer.app, sevillaespino, d0zer, enm1, kriang3tee, imtase, akioexzgamer, paopaoza, ten-years-before, univers.crypto, trxjjbtc, mintawa.app, amsnoopy, banko, steementertainer, kingscrown, arnel, arunava, angelusnoctum, artonmysleeve, mawit07, raiser, guifaquetti, uyobong, moiscapsesii, conectionbot, gogoo, willielow, brofund, logicforce, nikoleondas, zemiatin, isaaclim, boatymcboatface, theshell, justyy, bearbear613, tradingideas, fr-ida, qtu, jewel-lover, moneybaby, edaz, jesusgarp93, mitchelljaworski, ajai, olaexcel, cards4u, keepit2, tina-tina, neo2, happiness19, kravata, ssc-token, morpheus2, arrixion, hashkings, sm-jewel, trinity2, wild.nature, dnflsms, sayee, ortanol, tradingideas2, flyinghigher, pindex, loope, r-monsters, upfundme, hivebuzz, discohedge, mamun123456, maxuvd, accelerator, bert0, laruche, travelwritemoney, dannychain, walterjay, aidefr, robotics101, pboulet, solarphasing, hive-143869, comprendre.hive, lpv, duke77, voltagrou, silenteyes, pradeep.sidd68, dragibusss, lizanomadsoul, anderssinho, manncpt, globalschool, brokenzombie, laloretoyya, tinyhousecryptos, taskmaster4450, russia-btc, francosteemvotes, evildido, daltono, elderson, arcange, jonsnow1983, filotasriza3, fengchao, raphaelle, nathanmars, kristall97, tribevibes, burntmd, vincentnijman, photolander, trucklife-family, paradigmprospect, mountainjewel, porters, steelborne, deeanndmathews, haleakala, anafae, kennyskitchen, alchemage, elamental, terrybrock, dbroze, eftnow, wearechange-co, ura-soul, hopehuggs, misslasvegas, antimedia, careywedler, krishool, borrowedearth, bobaphet, metama, vibesforlife, hedidylan, jadung, psycultureradio, abundance.tribe, thomasinasepulve, jeronimorubio, gohive, joanstewart, dubignyp, terminado, artemislives, ezrider, rombtc, amarbir, done, goldvault, pdq, goldkey, hijosdelhombre, txrose, redwarbull, bluemoon, tribesteemup, as31, sterlinluxan, johnvibes, catherinebleish, dannyshine, tftproject, freebornangel, makinstuff, whatamidoing, bryandivisions, solarsupermama, lishu, firststeps, moxieme, hempress, homestead-guru, steemsmarter, nateonsteemit, indigoocean, geliquasjourney, cambridgeport90, nickhans, phillyc, fenngen, vientolibre, marxrab, brandnewaccount, shit-posts, rihanna2, binkyprod, fulcrumleader, antisocialists, nutritree, renataboreal, evegrace, freemotherearth, build-it, rmach, bruzzy, leovote, vishalsingh4997, egonz, haileyscomet, sanderjansenart, mammasitta, borislavzlatanov, bleuxwolf, maujmasti, seikatsumkt, abrahan414, luminaryhmo, eaglespirit, truthabides, hesoyam, beehivetrader, imcore, sudutpandang, belleamie, bsameep, mchandra, drqamranbashir, asnaeb, jfang003, churdtzu, bia.birch, captaincryptic, baguvix, vegan.niinja, builderofcastles, monica-ene, pdnejoh, nomad-magus, happydaddyfr, reonarudo, kieranpearson, sovereignalien, brightstar, icuz, vxn666, coriolis, heart-to-heart, kendewitt, specific, bewithbreath, cmmemes, mannacurrency, alexvan, colinhoward, canadianrenegade, celestialcow, inspirewithwords, santigs, onealfa.leo, marketinggeek, funtraveller, michelmake, luppers, linco-leo, creators-voter, fijimermaid, nonsowrites, ikibaru-san, zangano, galberto, ejmh, tariqul.bibm, nohyperec, corndog54, softworld, preparedwombat, razack-pulo, maskuncoro, shtup, bradleyarrow, lebah, frankydoodle, globetrottergcc, ericburgoyne, dimsyto, linco, lebey1, bonnie30, elizabetamt, bizventures, curtawakening, rcaine, greatness96, oredebby, cruisin, hirohurl, robwillmann, invest4free, kaseldz, ayhamyou, medaymane, aslehansen, flaxz, thisisawesome, improbableliason, maddogmike, globalcurrencies, clicktrackprofit, jersteemit, blainjones, iamraincrystal, khazrakh.leo, khazrakh, successchar, djsl82, emrebeyler.leo, bigtakosensei, gurseerat, guurry123, mk992039, circa, behiver, lightsplasher, meowcurator, romirspc, razam, louisthomas, iktisat, denizcakmak, bitcoinflood, funnel, stayoutoftherz, ackza, smon-fan, jessy22, gdhaetae, frankbacon, flauwy, nrg, agr8buzz, xyzashu, dhingvimal, jkramer, ribalinux, drunksamurai, brampton10, fiberfrau, florian-glechner, bengiles, loliver, ssjsasha, hivecoffee, bala-ag, mango-ag, opinizeunltd, bala-pal, rehan-leo, schibasport, jmotip, jphamer1, ammonite, spectrumecons, vegoutt-travel, captainhive, steemshiro, timodell7, steliosfan, quediceharry, curatorcat.pal, bagofincome, zurki, khan.dayyanz, numanbutt, mattclarke, cryptographic, automaton, pouchon, chrisparis, tomhall.leo, almi, lnakuma, trumpikasleo, jmsansan.leo, gattino, steemik, eroche, shahab021, mobi72, hivelifebg, thethreehugs, tandara, hectorsanchez18, liuke96player, ecuaminte, remenzer, pvinny69, hive-189742, ppp333, tomhall, road2nowhere, titusfrost, manniman, eddie-earner, livingdigitally, albertocaeiro, drag33, onestop, janusface, elevator09, zoidsoft, goldindigo, kharma.scribbles, celestal, driedfruit, georgeknowsall, cyptomaster, apofis, tecnoadicto, wheelly.dope, cmplxty.leo, teammo, wiseagent, gscmaster, tfranzini, joeylim, gungunkrishu.leo, ravthijo, sv-krasnova, brettpullen, futurecurrency, crypto619, camanda, roger5120, urun, renegadetrader, shadowmask, curatorcat.leo, code4040, cryptolohy, uyobong.venture, babalor, vimukthi, johnhtims, jelly13, chinchilla, mariosfame, academialibertad, atma.love, sadiq689, akumagai, alypanda, madisonelizabeth, mattbee, organduo, untersatz, laputis, abdullah.shafiq, cryptycoon, soluce07, diegor, doitvoluntarily, saswat036, firayumni, funt33, mgzayyar, hamza-sheikh, cryptoandcoffee, philnewton, antisocialist, koxmicart, silvervault, tanzofett, stortebeker, boucaron, pal.alfa, neoxian.alfa, ivansnz, perfspots, hungerstream, videosteemit, theatdhe, saberdemarketing, benhaleymade, drax.leo, davidesimoncini, mrs.goldkey, cryptocopy, toocurious, scooter77, krishu.pal, st8z, khan8465, chris-uk, slobberchops.leo, cryptictruth, notaboutme, cryptoph0823, silverkey, cryptoclerk,