Here Comes The Deflation

hive-167922·@taskmaster4450le·

0.000 HBDHere Comes The Deflation

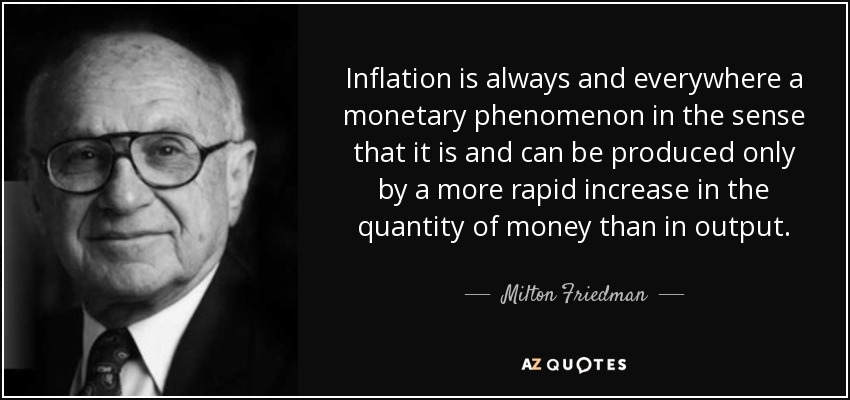

There is an inescapable fact that we cannot avoid: When it comes to [interest rate](https://leofinance.io/@leoglossary/leoglossary-interest-rate) hikes, there is a lag. In other words, whatever happens with interest rates, it take a good 9-12 months to filter through the [economy](https://leofinance.io/@leoglossary/leoglossary-economy). This is something that people often forget. Nothing a [central bank](https://leofinance.io/@leoglossary/leoglossary-central-bank) does, including the Fed, is immediate. They have their meetings and whatever decisions are made, it is looking out at least 12 months. The economy is like turning an [oil](https://leofinance.io/@leoglossary/leoglossary-oil) tanker, now a canoe. Macroeconomic analysis requires looking at things in their proper time frame. Here is where we could be in for a heap of trouble. We are now seeing [data](https://leofinance.io/@leoglossary/leoglossary-data) that is backing up what many of us were saying all along: the [price](https://leofinance.io/@leoglossary/leoglossary-price) increases were not inflation and hence were going to be transitory.  <center>[Source](https://www.azquotes.com/picture-quotes/quote-inflation-is-always-and-everywhere-a-monetary-phenomenon-in-the-sense-that-it-is-and-milton-friedman-70-30-98.jpg)</center> ### Inflation We need to understand [inflation](https://leofinance.io/@leoglossary/leoglossary-inflation). As Milton Friedman said, it is a monetary phenomenon. This means an expansion of the [money supply](https://leofinance.io/@leoglossary/leoglossary-money-supply). Unfortuately, contrary to what the Twitter economists proclaim, there was very little expansion in the [USD](https://leofinance.io/@leoglossary/leoglossary-usd). In fact, since Q3 2008, the money supply expanded at 1.03% annually. This is derived from going through the Z1. What took place in 2020 was a massive supply shock. Have you hear CEOs talking about supply chain disruption. This is what took place. There was too much demand for products as production slowed down (due to closing the global economy). Services dropped off a cliff and are still below 2019 levels. Hence we have [the Fed](https://leofinance.io/@leoglossary/leoglossary-federal-reserve-bank-the-fed) fighting something they didn't create. The simply fact is the Fed has one option: crush demand which also means crash the economy. As Powell stated, raising interest rates does not get any more oil out of the ground. Since we aren't dealing with inflation, there isn't enough [money](https://leofinance.io/@leoglossary/leoglossary-money) to sustain higher prices. This is another rather simple concept. As they say in the [commodity](https://leofinance.io/@leoglossary/leoglossary-commodity) world, the solution to higher prices is higher prices. Eventually people start to shift demand. This is what happened as we see demand across the board waning. Yet the Fed is still on course to keep raising. In its world of sunshine and flying elephants, the data says all is well. ### The Data Is Screaming How Bad Things Are We started banging this drum even before the first interest rate hike. Inventories in Q4 2021 saw record jumps. This was the first sign things were bad. Next we had the [LIBOR](https://leofinance.io/@leoglossary/leoglossary-libor) yield curve invert. That was warning sign two. After that, the [Treasury](https://leofinance.io/@leoglossary/leoglossary-us-treasuries) [yield curve](https://leofinance.io/@leoglossary/leoglossary-yield-curve) inverted. By the way, both have gotten sicker throughout 2022. Housing prices peaked in June 2021 and showed a classic topping pattern throughout the last 18 months. New home construction was showing signs of trouble as builders were having to discount houses as soon as they hit the [market](https://leofinance.io/@leoglossary/leoglossary-market). The automobile sector, globally, is still nothing but carnage. While 2021 did see some improvement, this is an overall 5 year drop. Commercial [banks](https://leofinance.io/@leoglossary/leoglossary-bank) started to tighten by cutting [credit card](https://leofinance.io/@leoglossary/leoglossary-credit-card) limits, cancelling [HELOCs](https://leofinance.io/@leoglossary/leoglossary-home-equity-line-of-credit-heloc), and reigning in [credit](https://leofinance.io/@leoglossary/leoglossary-credit) lines. Suddenly, we start hearing how cars cannot be given away at the auctions. Many dealerships are starting to lay off people. The [tech](https://leofinance.io/@leoglossary/leoglossary-technology) sector is getting hammered, with many companies including Meta and Twitter laying off large portions of their workforce. Even Goldman Sachs is unloading 8% of its employees. PPI in Germany is dropping. The pricing indexes in China look like a trainwreck. EU growth is likely just about gone. China is likely flat although they will present figures that make it look good. Yet Powell and his merry band of misfits keep chugging along. ### Deflation Tends To Be A Spiral As stated on numerous occasions, many feel that inflation is bad so [deflation](https://leofinance.io/@leoglossary/leoglossary-deflation) is good. After all, it is great when the price of stuff gets less expensive. The problem with that is we tend to look at things as consumers. This is where most are led astray. We need to understand what the money players and [businesses](https://leofinance.io/@leoglossary/leoglossary-business) are doing. That is where the impact comes from. Deflationary spirals are never good. To start, [asset](https://leofinance.io/@leoglossary/leoglossary-asset) prices collapse. Sends [defaults](https://leofinance.io/@leoglossary/leoglossary-default) skyrocketing. Of course, this is countered by even further tightening of credit, meaning expansion cannot take place. Companies find themselves with declining sales. Their response is to cut [expenses](https://leofinance.io/@leoglossary/leoglossary-expense) which always means reducing headcounts. As household [incomes](https://leofinance.io/@leoglossary/leoglossary-income) start to get hit, spending declines. CFOs are also onboard with this mindset. They start rejecting the funding of projects as companies try to weather the rough patch. Again, this starts to filter throughout the economy as money is pulled. Sadly, the flip from higher prices to deflationary pressures can be swift. Even looking at [commodities](https://leofinance.io/@leoglossary/leoglossary-commodity), which have every reason to be elevated, we see some present weakness. In short, demand is taking over. When there is a lot of talk about [recession](https://leofinance.io/@leoglossary/leoglossary-recession), it becomes a self-fulfilling prophecy as people start to prepare like one is coming. The cutback in spending equates to recession forces growing. People want to look at things on a short-term basis. In macroeconomics, two years is short term. This was always a temporary situation, one that was going to reverse and hard. It is a safe bet that 2023 will not have inflation as the major [economic](https://leofinance.io/@leoglossary/leoglossary-economic) topic of conversation. ___ If you found this article informative, please give an upvote and rehive. https://images.hive.blog/0x0/https://files.peakd.com/file/peakd-hive/doze/MkkDNhyH-2020_04_13_16_57_48.gif gif by @doze  logo by @st8z Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@taskmaster4450le/here-comes-the-deflation)

👍 joeyarnoldvn, myvest, nextgen622, hhayweaver, yameen, tsurmb, shortsegments, akane47, successforall, tronsformer, warmstill, dalz1, bruleo, leomaniacsgr, vanidike, hankanon, caladan, darewealth, vxn666, moeen.leo, finguru, vrezyy, knowhow92, sumatranate.leo, completewind, mcsherriff, maakue, onealfa.leo, mary.janikowski, glimpsytips.dex, ew-and-patterns, webdeals, marketinggeek, oakshieldholding, jacuzzi, senstlessmonster, empoderat, moonappics, surya1adiga, officialhisha, jmsansan.hive, hykss.leo, luckyali.leo, trasto, kooza, exiledrealm, youdontknowme, pjansen.leo, kaniz, adambarratt, scooter77, shebe, topbooster.leo, gonklavez9, captainbob, aiovo, coolguy123.leo, bozz, borniet, spectrumecons, victor-alexander, photosnap, vegoutt-travel, captainhive, alexicp, znnuksfe, litesplasher, rezoanulv.leo, criptoar, libertyctp27, forexbrokr, buggedout, noboxes, yieldgrower, piensocrates, zemiatin1, kendewitt, epic-fail, netaterra.leo, crypto-guides, gringalicious, beeyou, trumpybear, offgridlife, beverages, l337m45732, lightflares, vicesrus, throwbackthurs, cryptological, fractalfrank, hornetsnest, hykss, thegames, pouchon.tribes, tulip1, excelsheets, leovoter, r0nd0n, invest.country, dinvest, neal.power, venarisyndicate, bitcoinflood, libertyleo27, freecompliments, petertag, melbourneswest, monica-ene, drax.leo, beehivetrader, limka, zdigital222, aljif7, hivecluster, jim888, uwelang, ifarmgirl-leo, leprechaun, da-dawn, meowcurator, slothburn, vikbuddy, cryptomaniacsgr, no-advice, city-of-dresden, crazydaisy, raythulhu, nthtv, ianballantine, vxc.leo, preparedwombat, bil.prag, lifeof.abdul, vcelier, coyotelation, whatsup, humbe, kristal24, cinqowy, affliction, zoidsoft, kriszrokk, jfang003, dwayne16, katerinaramm, aboutheraklion, lanny0938, gadrian, jkr88, hosgug, fatman, trostparadox, xyba, cmplxty.leo, siphon, esecholito, edkarnie, stefano.massari, heroldius, listnerds, cmmemes, daltono, elderson, flowerbaby, the13anarchist, gungunkrishu.leo, deflacion, fw206, edicted, iansart, bpcvoter, onealfa, joseph23, acesontop, cryptoandcoffee, philnewton, src3, andablackwidow, hivebuzz, lizanomadsoul, manncpt, globalschool, schmidi, tinyhousecryptos, mammasitta, ukulima, ferod23, fengchao, anacristinasilva, onlycrypto, videosteemit, mayor333, stortebeker, shainemata, davchi2, master-lamps.ctp, holovision, holovision.cash,