Publicly Traded Bitcoin Miners Make Up 20% Of Hashrate

hive-167922·@taskmaster4450le·

0.000 HBDPublicly Traded Bitcoin Miners Make Up 20% Of Hashrate

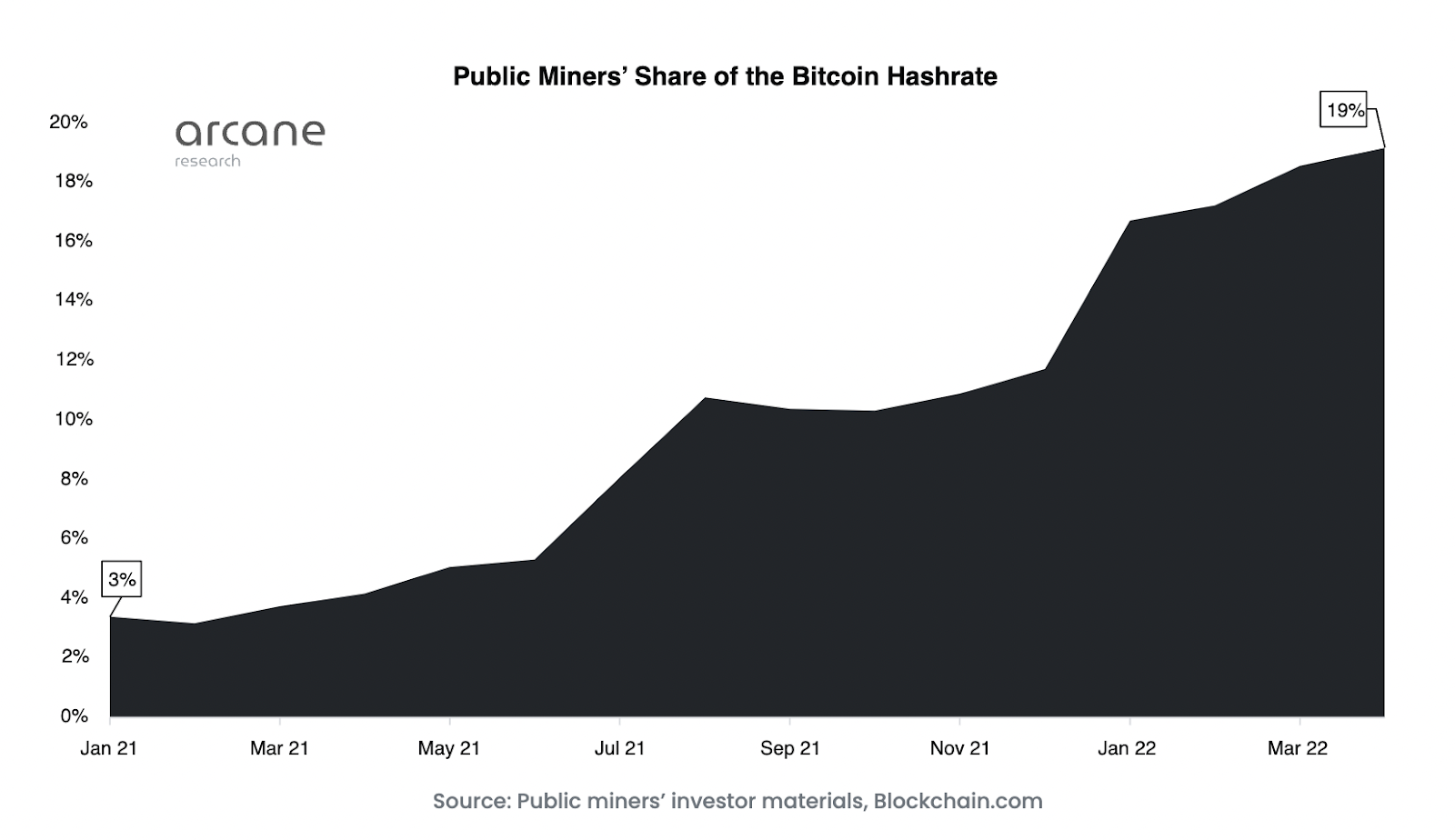

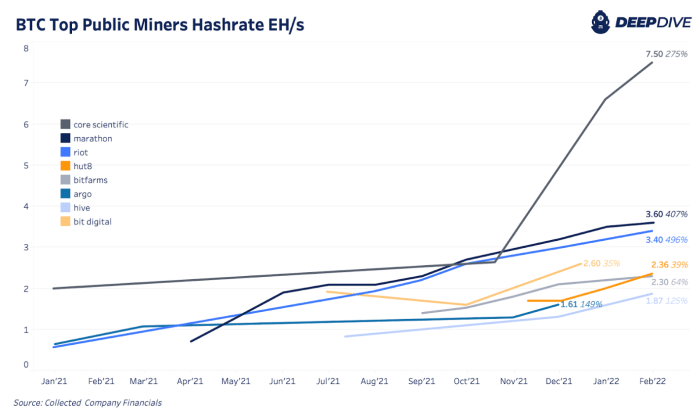

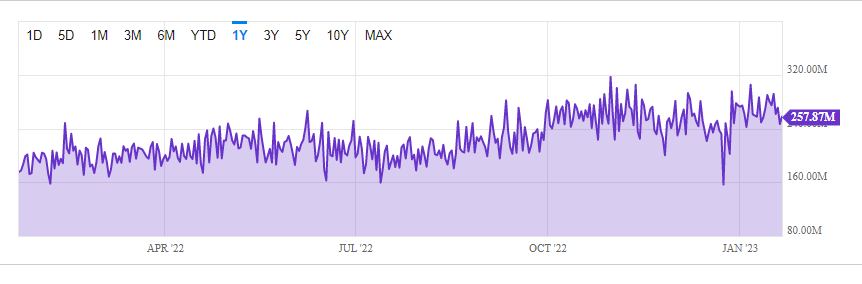

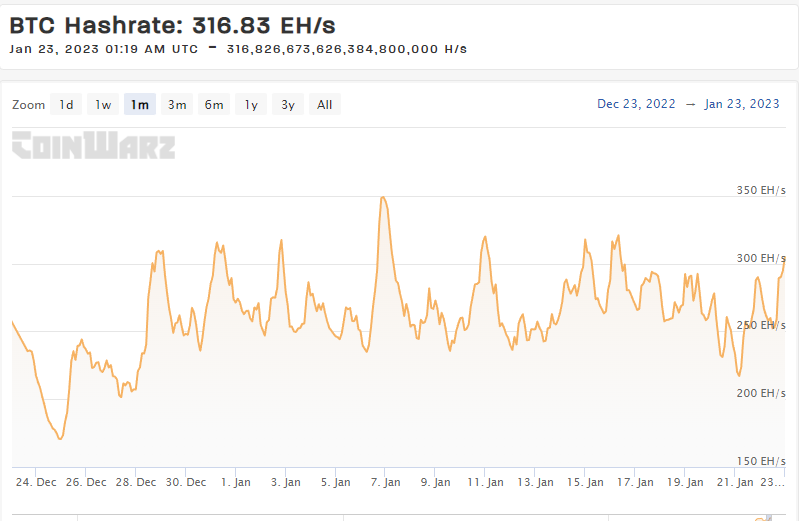

The distribution of [Bitcoin](https://leofinance.io/@leoglossary/leoglossary-bitcoin) miners is something that is heavily watched. This dates back a few years ago when China banned [cryptocurrency](https://leofinance.io/@leoglossary/cryptocurrency) mining. At the time, that country was leading, at least with Bitcoin [hash rate](https://leofinance.io/@leoglossary/leoglossary-hash-rate). As soon as that happened, countries around the world started vying for the relocation. The United States was no exception, with states such as Texas pulling out the red carpet treatment to attract them. There is no doubt that Bitcoin mining is big [business](https://leofinance.io/@leoglossary/leoglossary-business). These days, the hashrate is controlled by large mining farms set up throughout the world. The global distribution helps although that is some consolidation showing up. One area that is seeing a massive shift is with regards to publicly traded companies. The hashrate of these firms has skyrocketed over the past few years. In this article we will explore what took place with the [corporations](https://leofinance.io/@leoglossary/leoglossary-corporation) and how this could affect the industry.  ### 20% Of Hashrate Now Publicly Traded The mining pools of publicly traded companies is garnering a larger share of the total hashrate on the [network](https://leofinance.io/@leoglossary/leoglossary-network). As we can see from the graphic above, the rate was just 3% in January 2021. By the middle of 2022, that number grew to 19%. This is quite a jump in such a short period of time. While the [data](https://leofinance.io/@leoglossary/leoglossary-data) is a bit dated, we did see a nice move higher even after Bitcoin peaked in [](https://leofinance.io/@leoglossary/leoglossary-price)price. Since that took place around November 2021, the rate of these companies kept increasing. What is vital is these companies saw a huge year or year jump. According to forecasts, it didn't appear they had any intention of slowing down. <center> [Source](https://bitcoinmagazine.com/.image/c_limit%2Ccs_srgb%2Cq_auto:good%2Cw_700/MTg3MzA1ODk2MjEyMTEzMjk0/top-public-miners-bitcoin-holdings.webp)</center> We can see these numbers are from earlier last year. Since that time, the total hash on the Bitcoin network has steadily increased.  <center>[Source](https://ycharts.com/indicators/bitcoin_network_hash_rate)</center> ### Miner Troubles The numbers on the second chart were usurped by the end of the year. Core Scientifica was at 14 EH/s when it filed for [bankruptcy](https://leofinance.io/@leoglossary/leoglossary-bankruptcy). It had increased its rig count to over 140,000 up from 70K earlier in the year. Unfortunately, while the Bitcoins kept rolling in, the price steadily dropped. The bear market was rough for cryptocurrency and miners felt the brunt like everyone else. With prices dropping so far, [profitability](https://leofinance.io/@leoglossary/leoglossary-profit) remains an issue. Noted Bitcoin bull Michael Saylor saw margin calls on his debt that was backed by his firm's Bitcoin holdings. >While the winter has claimed its fair share of [block reward](https://leofinance.io/@leoglossary/leoglossary-block-reward) miners, Core Scientific is by far the largest casualty. The company directly operates 143,000 mining rigs, according to its most recent filing with the SEC. It hosts another 100,000 rigs for other miners. >As of the end of October, its rigs generated 14.4 exahash per second (EH/s) of BTC hash rate, with the other hosted rigs generating another 10 EH/s. Collectively, Core Scientific accounted for a bit over 10% of the global BTC hash rate. <center>[Source](https://coingeek.com/btc-miner-core-scientific-files-for-bankruptcy/)</center> The company entered reorganization meaning that it is still operating. The goal is to reduce/renegotiate the [debt](https://leofinance.io/@leoglossary/leoglossary-debt) and continue operations. A run in price would certainly help matters for the miners who are still collecting block rewards but selling at a much reduced price. ### Public Miners A Good Thing? While there is the potential for these mega-mining pools to consume a larger share of the hashrate, the question is whether this is a good thing or not? We can see that 20% is an impressive figure. However, it is still a far cry from the point where a [51% attack](https://leofinance.io/@leoglossary/leoglossary-51-attack) is possible. Also, we have to keep in mind that we are dealing with public companies as one entity yet it is comprised of roughly 25 different firms. Core Scientifica, is the largest with the 14 EH/s. Here we see the total hash rate:  <center>[Source](https://www.coinwarz.com/mining/bitcoin/hashrate-chart)</center> That means the largest publicly traded mining operater is accounting for 4.55% of the total. Everyone else, obviously, is below this. The one advantage to publicly traded companies is that many people can buy into it. Obviously, getting involved with something that is in bankruptcy is risky. Nevertheless, for those who want into the mining game, this is a path that can be followed. Mining, no matter what the approach, comes with [risks](https://leofinance.io/@leoglossary/leoglossary-risk). As we exit [crypto-winter](https://leofinance.io/@leoglossary/leoglossary-crypto-winter), it will be interesting to see how the mining pools reorganize and if the trend of the last few years, in terms of the hash, continues. *None of this is financial advice. This article is for informatinal purposes only.* ___ If you found this article informative, please give an upvote and rehive. https://images.hive.blog/0x0/https://files.peakd.com/file/peakd-hive/doze/MkkDNhyH-2020_04_13_16_57_48.gif gif by @doze  logo by @st8z * [What is Hive](https://leofinance.io/@leoglossary/leoglossary-what-is-hive) Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@taskmaster4450le/publicly-traded-bitcoin-miners-make-up-20-of-hashrate)

👍 writeandearn, elianaicgomes, akane47, yameen, jfang003, hankanon, forsakensushi, harryji, blainjones, bruleo, warmstill, cbridges573, peckypeace, diamondcare, youarecreative, halleluyah, anicom.vote, hhayweaver, darewealth, tsurmb, tronsformer, engrsayful, completewind, hykss.leo, mann0000, duncanek, keeper-of-eden, bank-of-hive, nextgen622, steemulant, teamvn, smartvote, steemtelly, lefty619, dalz1, myvest, vanidike, vrezyy, joeyarnoldvn, adamada.leo, lucky7ace, ffcrossculture, nervi, sumatranate.leo, strenue, shortsegments, flipstar.sports, moeen.leo, felander.leo, leomaniacsgr, vxn666, etorobong, knowhow92, hive-117638, maakue, mickymouse, shebe, mrsbozz, mary.janikowski, pjansen.leo, pjansen.ctp, kaniz, life-timer, adambarratt, cageon360, aiovo, ph1102.leo, coolguy123.leo, captainbob, bozz, spectrumecons, resiliencia.pal, vegoutt-travel, captainhive, photosnap, alexicp, lionsuit, redes, chorock, borniet, litesplasher, epic-fail, buggedout, noboxes, kendewitt, rezoanulv.leo, yieldgrower, trumpybear, forexbrokr, gringalicious, znnuksfe, d0zer, noborders, beeyou, libertyctp27, crypto-guides, criptoar, zemiatin1, uyobong, netaterra.leo, leoball, beverages, lightflares, vicesrus, throwbackthurs, cryptological, fractalfrank, hornetsnest, pouchon, sevenoh-fiveoh, curatorcat.leo, preparedwombat, libertyleo27, petertag, peter-bot, jim888, briight, magnolia-maggie, monica-ene, gloriaolar, da-dawn, new-world-steem, drax.leo, abh12345.leo, meesterleo, beehivetrader, omarcitorojas, pishio, ctpx, jinvest, vincentmfotos, ifarmgirl, zoidsoft, meowcurator, officialhisha, doitvoluntarily, edkarnie, nthtv, edicted, iansart, anonsteve, onealfa, joseph23, scaredycatguide, swelker101, leoschein, gualteramarelo, bananass, megaleoschein, dugsix, bhealy, generatornation, darinapogodina, maurofolco, tokenizedsociety, marianis, esecholito, raythulhu, coyotelation, anderssinho, eddie-3speak, eforucom.leo, summertooth, vikbuddy, trostparadox, davidbright, xyba, muratkbesiroglu, limka, papilloncharity, markkujantunen, davidlionfish, zdigital222, onealfa.vyb, rxhector, nikoleondas, chincoculbert, daltono, elderson, flowerbaby, the13anarchist, thecuriousfool, onealfa.leo, cmplxty.leo, tomhall.leo, heruvim1978, ferod23, fw206, stortebeker, stefano.massari, andablackwidow, cryptoandcoffee, philnewton, src3, pob.curator, duwiky, jk6276, trumpikasleo, hivebuzz, cwow2, hixt.main, listnerds, arcange, achimmertens, rohansuares, shainemata, steemitboard, marivic10, raphaelle, fengchao, ukulima, anacristinasilva, holovision, slothburn, politicalhive, master-lamps.ctp,