The World Is Not De-Dollarizing - It Is Being De-Dollared

hive-167922·@taskmaster4450le·

0.000 HBDThe World Is Not De-Dollarizing - It Is Being De-Dollared

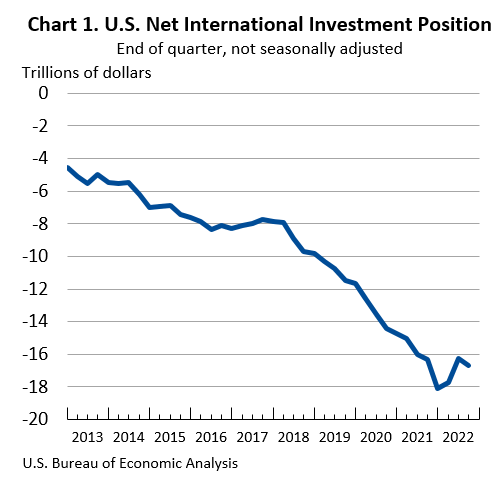

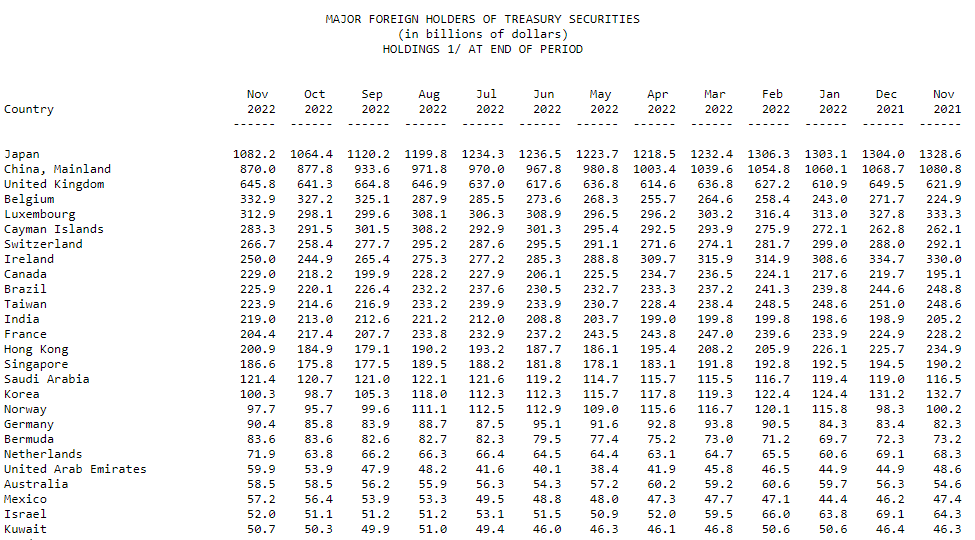

The [monetary system](https://leofinance.io/@leoglossary/leoglossary-monetary-system) is a lot more complex than people understand it to be. Most look at a central bank like [the Fed](https://leofinance.io/@leoglossary/leoglossary-federal-reserve-bank-the-fed) and believe that tells the story. They might understand a [currency](https://leofinance.io/@leoglossary/leoglossary-currency) such as the USD, [EUR](https://leofinance.io/@leoglossary/leoglossary-eur-currency), or [GBP](https://leofinance.io/@leoglossary/leoglossary-gbp-currency), believing that is what we need to know. Unfortunately, that is only a small piece of the entire monetary puzzle. For example, are you aware that we have: * [central bank money](https://leofinance.io/@leoglossary/leoglossary-central-bank-money) * [commercial bank money](https://leofinance.io/@leoglossary/leoglossary-commercial-bank-money) * [Eurodollar System](https://leofinance.io/@leoglossary/leoglossary-eurodollar-system-market) money All of these operate simultaneously while having an impact upon the [economy](https://leofinance.io/@leoglossary/leoglossary-economy). Actually, the one with the least effect is the central bank money. This misunderstanding is what allows [central banks](https://leofinance.io/@leoglossary/leoglossary-central-bank) to act like they are relevant. In reality, the are a minor piece of the equation, best ignored Sadly, people hang on their words like they are gospel. Nevertheless, let's dive into some mythology that is presently out there surrounding the monetary sitution and what is taking place.  <center>[Source](https://thehill.com/wp-content/uploads/sites/2/2017/01/dollar_yuan631048518.jpg?w=1280)</center> ## Countries De-dollarizing? For the most part, this is a total myth. There is only one country that de-dollarized and that was Russia. The rest, do not fall into this camp. Instead, they are being [de-dollared](https://leofinance.io/@leoglossary/leoglossary-de-dollared). What is the difference? Russia decided it wanted to reduce its exposure to the United States. This was a decision made in 2018, a time when they started to unload their [US dollar](https://leofinance.io/@leoglossary/leoglossary-u-s-dollar) denominated assets. A large part of it was selling US Treasuries. The motivation was not due to a lack of confidence. In fact, the Russians were very confident in the US Government; confident they would get screwed. And the USG did not disappoint. Even with the [de-dollarization](https://leofinance.io/@leoglossary/leoglossary-de-dollarization), they still took it on the lip with a $600 million bond [payment](https://leofinance.io/@leoglossary/leoglossary-payment) that was stopped. Imagine if the Russians were sitting hundreds of billions in [US Treasuries](https://leofinance.io/@leoglossary/leoglossary-us-treasuries). Obviously, the Russian thought about this. As for the rest of the world, it is not falling under this umbrella. ## De-dollared The rest are being de-dollared. This means that they are having to sell their US denominated [assets](https://leofinance.io/@leoglossary/leoglossary-asset), mostly bonds, to get their hands on dollars. It is a situation that arose coming out of the [Great Financial Crisis](https://leofinance.io/@leoglossary/leoglossary-great-financial-crisis) due to the contraction in [collateral](https://leofinance.io/@leoglossary/leoglossary-collateral). This severely impacted the Eurodollar System which is, at this point, broken. Central banks have to be able to put their hands on dollars so they can have them readily available to the commercial banking system. Remember, almost half the global [debt](https://leofinance.io/@leoglossary/leoglossary-debt) is denominated in USD. That means countries from all over the world have to access dollars for [repayment](https://leofinance.io/@leoglossary/leoglossary-repayment). If the banking system cannot provide this, [default](https://leofinance.io/@leoglossary/leoglossary-default) is the [risk](https://leofinance.io/@leoglossary/leoglossary-risk). That is why we see countries selling their Treasuries. People believe they are trying to get away from the dollar. If that was the case, it seems their residents of non-US countries are doing the exact oppsite. Here is the latest [Net International Investment Position](https://www.bea.gov/news/2022/us-international-investment-position-3rd-quarter-2022) report: <center></center> For those who are unaware of how this works: >The U.S. net international investment position, the difference between U.S. residents' foreign financial assets and liabilities, was –$16.71 trillion at the end of the third quarter of 2022, according to statistics released today by the U.S. Bureau of Economic Analysis. Assets totaled $29.73 trillion, and liabilities were $46.44 trillion. At the end of the second quarter, the net investment position was –$16.29 trillion (revised). [Liabilities](https://leofinance.io/@leoglossary/leoglossary-liability) are US denominated assets owned by non-US citizens (and entities). Assets are foreign assets that are owned by US citizens (and entities). For the past decade, [capital](https://leofinance.io/@leoglossary/leoglossary-capital) flow is obviously into US denominated assets, not exactly what people are preaching. If this is the case, why are the BOJ and PBOC unloading Treasuries? Once again, they need dollars. This is the easiest way to get a hold of this. ## TIC Data The foreign holdings of US Treasuries tell the entire story. Here is the latest [Tic Data](https://ticdata.treasury.gov/Publish/mfh.txt):  This shows the trend of the two largest foreign holders of US debt. As we can see, both countries experienced a huge decline. There is another part of this equation: these are the two largest economies after the United States. They both have significant trade with the U.S. (China beint the largest in total trade). Each actually runs a deficit with the U.S. which means they have [USD](https://leofinance.io/@leoglossary/leoglossary-usd) flowing in. Yet they still has to unload the Treasuries to keep operations going. For example, Japanese [banks](https://leofinance.io/@leoglossary/leoglossary-bank) just unloaded a significant amount of UST to try and prop up the yen. These countries feel like they are under attack, leading some to speculate whether the USG is weaponizing the dollar. The answer to that question is outside the scope of this article. What we do know, however, is the Eurodollar System is experience [balance sheet](https://leofinance.io/@leoglossary/leoglossary-balance-sheet) contraint. This is hindering global [trade](https://leofinance.io/@leoglossary/leoglossary-trade). Until there is some other form of collateral that steps up, we are going to see a continued eradication of the system. Ultimately, this leads to countries being de-dollared. This is one of the reasons why the Fed opened up currency swap lines with many of the central banks around the world. [Liquidity](https://leofinance.io/@leoglossary/leoglossary-liquidity) in the USD is simply not there. ___ If you found this article informative, please give an upvote and rehive. https://images.hive.blog/0x0/https://files.peakd.com/file/peakd-hive/doze/MkkDNhyH-2020_04_13_16_57_48.gif gif by @doze  logo by @st8z * [What is Hive](https://leofinance.io/@leoglossary/leoglossary-what-is-hive) Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@taskmaster4450le/the-world-is-not-de-dollarizing-it-is-being-de-dollared)

👍 moeen.leo, joeyarnoldvn, elianaicgomes, vrezyy, writeandearn, hykss.leo, finguru, yameen, blainjones, tronsformer, lefty619, cbridges573, akane47, harryji, bruleo, felander.leo, completewind, diamondcare, forsakensushi, youarecreative, halleluyah, anicom.vote, nervi, sumatranate.leo, duncanek, hhayweaver, flipstar.sports, vanidike, keeper-of-eden, bank-of-hive, smartvote, shortsegments, engrsayful, leomaniacsgr, warmstill, myvest, hankanon, nextgen622, vxn666, adamada.leo, lucky7ace, knowhow92, ffcrossculture, etorobong, shebe, mickymouse, ew-and-patterns, maakue, mrsbozz, mary.janikowski, gerber, ezzy, exyle, steem.leo, mice-k, dcityrewards, nateaguila, dlike, ribary, jelly-cz, joele, dcrops, adambarratt, sahil07, life-timer, mercurial9, gonklavez9, cageon360, holoferncro, captainbob, ph1102.leo, coolguy123.leo, cryptosimplify, photosnap, victor-alexander, resiliencia.pal, spectrumecons, chorock, bozz, vegoutt-travel, captainhive, znnuksfe, litesplasher, alexicp, buggedout, noboxes, netaterra.leo, leoball, penguinpablo, cryptonized, kendewitt, gringalicious, forexbrokr, rezoanulv.leo, yieldgrower, criptoar, beeyou, funnyman, alphacore, epic-fail, d0zer, piensocrates, hungrybear, zemiatin1, belemo.leo, libertyctp27, crypto-guides, noborders, uyobong, josequintana, jacuzzi, trumpybear, edipascal, humoalex, ambar, beverages, thegames, lightflares, vicesrus, throwbackthurs, cryptological, fractalfrank, hornetsnest, forykw, pouchon.tribes, pladozero, pouchon, sevenoh-fiveoh, curatorcat.leo, skiptvads, avatara, petertag, libertyleo27, peter-bot, trostparadox, davidbright, raythulhu, briight, magnolia-maggie, abh12345.leo, drax.leo, meesterleo, beehivetrader, tokenizedsociety, xyba, rentmoney, meowcurator, officialhisha, preparedwombat, gduran, gislandpoetic, panosdada.tip, esecholito, myfreebtc, vikbuddy, eddie-3speak, jongolson, ericburgoyne, cryptoccshow, bitcoinflood, coyotelation, sydechan, urun, empress-eremmy, steemstreems, kriszrokk, steem-key, jfang003, limka, ijelady, cmplxty.leo, yann03, yogajill, ferod23, tomhall.leo, stortebeker, jerrythefarmer, daltono, elderson, flowerbaby, the13anarchist, davidlionfish, scaredycatguide, swelker101, leoschein, gualteramarelo, bananass, megaleoschein, dugsix, bhealy, generatornation, darinapogodina, maurofolco, listnerds, videosteemit, fw206, markkujantunen, omarrojas, eforucom.leo, edkarnie, nenio, cryptoandcoffee, philnewton, src3, ukulima, acesontop, rtonline, jk6276, heruvim1978, andablackwidow, teutoboch, hivebuzz, cwow2, sapphirecrypto, fengchao, arcange, shainemata, steemitboard, marivic10, zoidsoft, anacristinasilva, neoxian, aamirijaz, joedukeg, marriakjozhegp, mami.sheh7, brofund-ag, akomoajong, abmakko, jlordc, anikys3reasure, xawi, meher04, sanjeev021, sharkthelion, memesupport, some-asshole, jlordz, dragonmk47, olujay, l337m45732, princessbusayo, eturnerx, onealfa.vyb, rxhector, rival, moonappics, chincoculbert, meestervyb, geneeverett, holovision, valued-customer, humbe, ctpx, omarcitorojas, darth-azrael,